The bond market turmoil in the UK that accompanied the short-lived premiership of Liz Truss during 2022 made it more difficult and costly to raise debt finance, but was not enough to put a meaningful dent in UK M&A transaction volume in financial services. Deals typically take 6 to 12 months from start to finish and so weathered the short-term market panic.

Fear that the government was planning to increase UK capital gains tax in its March 2021 budget drove a spectacular jump in the number of privately owned insurance brokers rushing for the exit. In the end the rumoured increase never happened and CGT rates remain the same today as they were then.

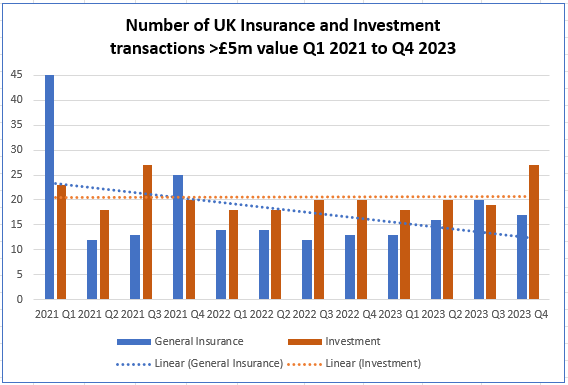

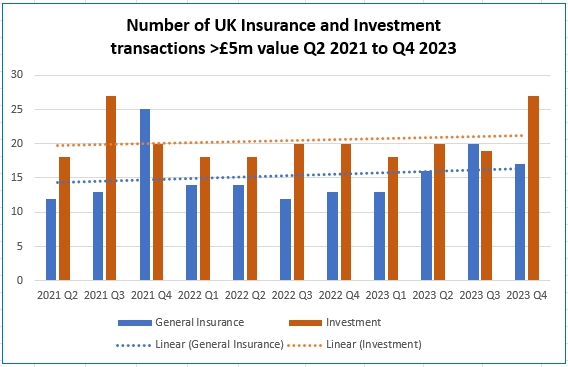

M&A activity over the last three years

Ignoring the anomalous Q1 2021 deal activity both the UK insurance and investment sectors have actually seen M&A volumes marginally increasing over the past two years.

This is not all good news for buyers with strong appetites. In insurance, we have seen a significant increase in prices being paid since the March 2021 budget (no doubt the increased supply depressed pricing in Q1 2021). Our cut-off point for the data shown here is deal values of £5m or more. Therefore there will be some businesses that in early 2021 would not have achieved a valuation above our of £5m threshold, but will be doing so in 2023.

It is also worth remembering that a £1 in April 2021 has, in real terms, lost over 15% of its value. So a business selling for £4.5m in April 2022, and excluded from data would today have made the £5m cut-off point.

But for sellers the above is good news, as it points to a reduction in supply. This is particularly marked in insurance being less than half the size of the investment industry. The replenishment rate (i.e. how quickly new businesses are being established and grown) is well below the exit rate and we see this as an important driver in the price increases we refer to above.

The internationalisation of the UK financial services sector is also driving value. Now as part of MarshBerry, we have unparalleled reach.

We will be publishing our annual M&A reviews (insurance and investment) which take a deep dive into the data. If you wish to receive a copy, please send us your email address to info@imas.uk.com and we will send you the reviews once published.

Insurance

The final month of 2023 proved to be a busy one for insurance M&A, with 13 new UK deals to report on, including four in the £100m+ bracket, to round off a year that has actually bucked some wider trends to see near-record levels of sector M&A in terms of volume, but a reduced level of overall M&A by value, with an increased number of very small deals being announced. We will be publishing detailed analysis of these trends in our annual review in a few weeks’ time.

Insurance broking M&A

The biggest UK deal of the month came with the news that Miller Insurance’s PE backer Cinven had agreed a deal to divest its interest in the business to GIC, the Singapore Sovereign Wealth Fund with which they had coinvested in the business as part of its buyout from Willis in a deal announced in 2020.

Other sizeable broking transactions included the announcement by Specialist Risk Group that it had agreed its sixth deal of 2023 and largest to date, acquiring B.P. Marsh-backed broker CBC Partnerships in a deal that SRG has said will add c.£10m of EBITDA to the group, AssuredPartners adding CIA Insurance Services in Rugby, and Jensten Group making another acquisition with a deal for Scrutton Bland in East Anglia.

Smaller broking deals in the month included Adler Fairways acquisition of Intelligent Real Estate Due Diligence (IREDD), Gomm Insurance Brokers in the West Midlands combining with Daulby Read Insurance in Chester, Hallsdale Insurance Brokers acquiring Allbright Bishop Rowley (ABR Insurance) in Leicester, Brown & Brown (Europe) making another acquisition in Wales with a deal for R McGee Insurance Brokers in Glamorgan, Ardonagh announcing the acquisition of Westfield Insurance in West Sussex, and Clear Group concluding its tenth UK acquisition of 2023 with a deal for the general insurance book of PW White & Partners in Buckinghamshire.

Other notable sector transactions

Away from broking, there were notable deals in the MGA segment (where 2023 was a record year for M&A in terms of deal volumes), in insurance services, and between insurers.

- In a major MGA deal that had previously been speculated on in the press, US-listed group Ryan Specialty announced that it would acquire Castel Underwriting Agencies, a London-based MGU platform, from Arch.

- Among risk carriers, it was announced that Admiral will acquire the UK direct personal lines business of Intact Financial subsidiary RSA Insurance, in a deal reportedly worth £115m.

- Ardonagh announced a deal to acquire RiskSTOP Group, a provider of insurance technology and risk management services that employs more than 200 staff.

Relevant overseas M&A

The biggest announced deal in the month was actually a US deal, but involving parties that both have sizeable UK operations so it worth a mention here. Aon announced that it will acquire NFP in a $13.4bn deal, the largest sector transaction of the year globally. NFP has a relatively low profile in the UK but has made a number of acquisitions here in the past few years, across both employee benefits and broking.

Unannounced transactions

Our annual roundup of sector M&A activity will include more detailed analysis (including headcount) of all of the deals included in these newsletters over the past twelve months, but also picks up deals that have not been publicly announced or reported on by the trade press, that we uncover through our research. A couple of recent examples to mention here include Stubben Edge Group becoming the controlling shareholder of Lloyd’s broker Blackmore Borley (notified in September), and Adler Fairways taking over the book of business of Bryan James & Co., a broker best known for its expertise in musical instruments cover.

Investment

M&A activity remained high amongst wealth managers until the very last few days before Christmas, maintaining the momentum in the sector that has been so strong throughout 2023. Notably, 7IM acquired London-based Amicus Wealth adding £1bn of client assets, while Liberate Wealth acquired Somerset-based Stafford House Investments, adding £275m of client assets and establishing a presence in the South West. Skerritts announced the acquisition of Chester-based Chadwick McLean adding £230m of client assets and Close Brothers acquired Dorset-based Bottriell Adams adding £220m in client assets. MKC Wealth aggregated an additional £90m of client assets with the purchases of Buxton-based Crescent Independent, and the clients of IFA Christine Brearley. Perspective announced it had acquired the client banks of Simon McGechie and Paul Adams, adding a total of £55m in client assets, as well as Colchester-based Park Lane Independent Financial Advisers, adding £135m in client assets. Similarly, Atomos also announced two transactions during the month, acquiring Plymouth-based Shore Financial Planning and Reigate-based Define Wealth. HFMC Wealth announced the acquisition of Edgware-based Harford Financial, taking its total AUA to £2bn, while Benchmark Capital acquired West Sussex-based Champain Financial Services adding £111m in client assets. Team Asset Management announced it had bought Jersey-based Homebuyer Financial Services adding £135m in AUA, while Soderberg & Partners announced the investment in a minority stake in London-based Generation Financial Services, and Finura announced the acquisition of Tenacity Wealth Management in Haslemere, adding £90m of client assets.

Finally, Fairstone ended the year by announcing a hattrick of acquisitions, including Kent-based advice firm Goodman Chartered Financial Planners, increasing its client assets by £160m, as well as two mortgage firms, Perthshire-based Next Home and Kent-based Bellegrove Mortgage Services, bolstering its mortgage lending arm.

There was also activity elsewhere in the sector, with Fintel agreeing to acquire Synaptic Software, a provider of adviser planning tools, for £3.5m plus a commitment of £0.5m for development, and Evelyn Partners acquiring Beaconsfield-based accountancy firm Harwood Hutton, further strengthening its professional services offering.

In the asset management space, US-based private equity firm Lincoln Peak Capital acquired a substantial minority stake in Troy Asset Management while US-based investment manager Polen Capital announced it was to take on the funds of Somerset Capital.

Financial services are globalising. Our coming together with MarshBerry, with its 200 staff spread across five offices in the US and further offices in the Netherlands, Germany and France, was driven by the recognition that Merger & Acquisition activity is increasingly reflecting cross-border opportunities in operations and capital flows. So, advisers need to expand their footprint accordingly. Being part of MarshBerry has given us global reach.

But whilst the sector is globalising, the details of just how this is happening very much depends on the particular activity. In commercial insurance broking, we have been introducing major US buyers to UK businesses that are thinking about their next phase of ownership. Most of these buyers have simply not been on the radar of such companies. In personal lines insurance, one of our clients has seen keen buyer interest from Continental Europe, where many buyers regard the UK market as more mature than their home market and the way Europe, albeit slowly, is moving.

The asset management industry – including in alternative assets – has for a long time been very international in its activities and ownership, while wealth management has largely remained the domain of more regionally focused and indeed often quite local businesses, albeit the sector is showing tentative signs of becoming more international in the wake of its rapid consolidation.

Given the wide disparity of interest between buyers across diverse markets, reaching the right buyers on a global basis is possible only with detailed knowledge of, and relationships with, a multitude of buyers. Together with MarshBerry, we offer over 40 years of M&A experience and 200 staff, to provide comprehensive and global solutions to our clients on the ground in the UK, Continental Europa and North America.

Insurance

November was a relatively quiet month in terms of the volume of new UK insurance M&A activity, with only eight new transactions to report on this month, but it was a notable month from a deal value point of view – there have only been five UK insurance distribution deals in 2023 (to date) with a value above £100m, but two of these were announced in November.

The most headline grabbing deal of the month was the acquisition of Romero Group, including both Romero Insurance Brokers and Club Insure, by AssuredPartners. The deal is AssuredPartners’ largest in the UK to date and will catapult them into the Top50 Brokers listing from 2024. The transaction was not AssuredPartners only deal in November, with a separate announcement that they had acquired Atom Insurance Brokers in Taunton coming only a few days after news of the Romero deal and further bolstering AssuredPartners’ strong position in the South West.

There were three other transactions in commercial broking in the month, from three separate but regular acquirers. Clear Group further increased its tally of deals for 2023 with the acquisition of Peter Hoare (Insurance Brokers) in Sheffield, Brown & Brown (Europe) subsidiary Green Insurance Group announced a deal for NSure in Worthing, and community broker Dickson & Co. Insurance announced that it had acquired fellow Northern Irish broker Kerr Insurance in a combination that will create one of the largest brokers in Northern Ireland, with more than 150 staff.

It was a relatively busy month on the personal lines side, with three new deals to report on. It was reported that Primary Group had sold a controlling interest in Qmetric Group, better known through its Policy Expert trading style, to the Abu Dhabi Investment Authority, an existing minority investor in the business (since 2021). Bspoke Insurance Group, the PE-backed MGA group that includes the former UK General Insurance and Precision Partnership businesses, announced a deal for various personal lines business from Police & Forces Mutual, which is now part of Royal London. Finally, Peter Cullum’s The Broker Investment Group took a 49% stake in Sale Insurance Services, a broker focused on arranging cover for individuals and small businesses who have previously been refused or struggled to find insurance.

Investment

M&A activity in the sector was primarily driven by dealmaking amongst wealth managers. Titan Wealth continued its M&A drive with the purchase of Bristol-based Aspira Corporate Solutions, increasing its AUM by £4bn, with the deal being announced shortly after the FCA authorised Parthenon Capital’s majority investment in Titan Wealth itself. Fairstone expanded its geographic footprint to several new regions, adding £500m in client assets with the acquisitions of Hampshire-based Station Financial IFA, County Durham-based Advanced Financial Services, and Norfolk-based Allen Tomas & Co. Perspective Financial Group added £205m in client assets in its 20th acquisition of the year with Chelmsford-based Primera Wealth Management. Foster Denovo announced two acquisitions during the month, taking on the employee benefits business of Punter Southall Aspire and £110m in client assets with the purchase of Hampshire-based Creative Financial Solutions. Lumin Wealth announced it had acquired Buckinghamshire-based B W Financial Consultants, adding £95m in AUM, while Fairey Associates announced it had purchased Norfolk-based Tailored Retirement & Investments Planning, adding £100m in client assets.

In Scotland, Canaccord Genuity Wealth Management acquired Glasgow-based Intelligent Capital, adding £220m in client assets to its recently acquired Adam & Co businesses. Loyal North acquired Galashiels-based Sovereign Financial Services with £60m in client assets, and Edinburgh-based Calton Wealth Management announced its first acquisition after buying Linlithgow-based Morrison Personalised Wealth Management.

Evelyn Partners bolstered its strategy of growing its professional services division by acquiring Kent-based accountancy firm Creaseys. The transaction perimeter excluded Creaseys’ advice arm, Creaseys Wealth, which was sold separately to Cooper Parry Wealth, who initially set up the joint venture with Creaseys back in 2015. As well as the £220m of client assets added in the transaction, Cooper Parry Wealth also acquired Chamberlyns, a Luton-based IFA with £250m of client assets, resulting in Cooper Parry Wealth’s total client assets exceeding £1.3bn.

There was also a spur of activity involving investment managers during the month, with Courtiers buying Norwich-based Brunswick Investment Management, adding £105m of AUM, and Premier Miton buying equities boutique Tellworth Investments, adding £559m of AUM. Toronto-based Manulife Investment Management acquired London-based multi-sector credit manager CQS and Amber River purchased a majority stake in adviser-focussed TAM Asset Management with just under £650m of AUM.

Elsewhere in the sector, wealth management firm Credo announced a merger with South African investment solutions provider Anchor and Royal London announced the acquisitions of later life lending and product specialists Responsible Life and Responsible Lending. In the Fintech space, financial services review and rating sites VouchedFor and AKG were acquired by Fintel. It was reported that Picton Property Income would be merging with investment trust UK Commercial Property (“UKCM”) however this was later blocked by Phoenix Life, UKCM’s majority shareholder.

The global financial crash of 2008 resulted in nearly 15 years of ‘cheap money,’ which in part explains why (debt fuelled) private equity (PE) firms have been active in consolidating the most fragmented segments of the UK financial services sector over the past several years.

Whilst the investment sector is fast catching up, the insurance distribution sector in the UK has been at the forefront of this consolidation. Indeed, so much so that over the past three years we have seen a slight decrease in the total number of PE-backed businesses. The emerging theme is that of globalisation, as the available supply of quality domestic assets to acquire reduces and the largest players (often but not exclusively U.S. based), seek out assets in overseas markets to feed their continuing acquisition ambitions. More expensive money swings the balance back somewhat, in favour of quoted groups and longer-term investors, and away from PE firms with a heavy reliance on high levels of leverage to generate their (high) target returns.

As the market globalises and cross-border mergers & acquisitions (M&A) becomes more prevalent, the options available to sellers domestically is narrowing – but widening globally.

To most effectively service clients, global reach is necessary.

In selling earlier this month to MarshBerry, we now have unmatched capabilities in North America and Europe, as part of a leading specialist advisory business with almost 200 colleagues across 11 offices. We also have new tools at our disposal, with experience and expertise in areas such as succession planning that widen the range of options we can provide to our clients.

We look forward to providing the same quality advice to our clients as we have always done. Now we just have more options for those clients to consider.

Insurance

October was another lively month in terms of newly announced insurance M&A in the UK, with fourteen new transactions to report on. Twelve of these were on the commercial broking side, with one personal lines business and one claims business.

Four separate buyers announced two new acquisitions each in October. Brown & Brown (Europe) was behind the largest transaction in the month, acquiring the highly regarded Berkeley Insurance Group in Leicester, as well as adding Davison & Associates and Davison Lamont in Northern Ireland, which will become part of its ABL Group business there. Jensten Group announced new deals for both Berns Brett in London and White Rose Insurance Solutions in Skitpton. NFP, which is becoming increasingly active in terms of deal activity, added The Cronin Insurance and Resolute Insurance Services, both in the West Midlands. Finally, Partners& announced deals for Stephensons Risk Management in Wigan and Beaumont, Lawrence & Co. in Shrewsbury.

Other regular buyers announcing new deals in October included Howden, now operating under a single brand (just in case you hadn’t heard about that yet …), which added Neilson Laurence & Neil in Glasgow, under what was formerly its Bruce Stevenson business, PIB Group, which announced the acquisition of RBIG Corporate Risk Services in Manchester, and The Broker Investment Group, which has increased its existing investment in Stevenson Seacombe Partnership to help support the businesses acquisition of BLS Insurance in Bury.

M&A is of course not (yet) the exclusive preserve of the professional consolidators and deal activity by privately held brokers is still taking place. During October Think Insurance Services in the West Midlands announced a deal for Ashby Wray in Wolverhampton, and newly established Prosura in Wakefield announced its first deal, acquiring First Stop Insurance Brokers in Sheffield.

Lastly, an overseas deal involving a target with staff on the ground here in the UK is worthy of a mention. Arthur J. Gallagher announced that it had acquired Clements Worldwide, a US broking group serving expats, diplomats and the military, whose Clements Europe arm has more than 30 staff here in the UK.

2023 will end up as another very busy year in terms of transaction volumes in UK insurance distribution, with c.150 new deals likely to have been announced by the end of December, however the number of deals alone does not tell the full story. As we have remarked here before and will explore more fully in our next annual review, the average deal size is getting smaller. Only one of the October deals set out above involved a target employing more than 50 staff. Nine of the 14 deals in October involved targets employing fewer than 10 staff.

Commentators and consolidators who cite continuing high levels of M&A and point to the fact that there are still c.2,000 brokers left in the UK (and perhaps a few dozen new ones starting up each year) as evidence that there is still lots of ‘runway’ to go after for buyers are missing the point. Most of these businesses are very small. We know this because we analyse every one of them by reported headcount. We also look at their profitability. Collectively, privately owned independent brokers control an increasingly marginal – and rapidly shrinking – proportion of overall GWP. For the bigger players to ‘move the dial’ through domestic bolt-on M&A is becoming increasingly difficult.

Investment

October resulted in another busy month led again by transactions involving wealth managers, including Titan’s acquisition of Prism Financial Advice, adding £630m in AUA, and Progeny’s acquisition of Carbon Financial Partners, adding £600m in AUM. Liberate Wealth launched its nationwide consolidation business with the acquisition of Yorkshire-based Ebor Financial Planning, bringing £200m of AUM and private equity firm Coniston Capital invested in a minority stake in national advice business MWA Financial in exchange for an injection of growth capital to increase MWA’s acquisition power and help accelerate growth. Perspective Financial Group continued its acquisitive streak by purchasing another four advice firms: Worthing-based Accord Financial Management, Rotherham-based RPG Financial, Sheffield-based Campbell Harrison and Halesowen-based Strategic Financial Portfolios, taking its acquisition count for 2023 to 19 and adding an additional £610m in assets. North-Yorkshire IFA firm Prosperis acquired its Knaresborough-based neighbour RMB Financial Management, and MKC Wealth bought a controlling stake in Wimbledon-based Holborn Financial from South African business Alpha Wealth. Carlisle-based Armstrong Watson acquired Penrith-based advice firm 3G Financial. MRW Group acquired Emet Financial Services, Merlin Wealth Planning and Mayfayre Financial Services after it received a loan note facility from OakNorth and Octopus Money announced it had acquired the customers of digital advice firm OpenMoney, which announced it was closing its investment arm.

In the asset management sector, Abrdn announced it was selling its £7.5bn AUM PE division to Cayman Islands-based Patria Investments for £100m and AssetCo sold its stake in RMI (River & Mercantile Infrastructure) for a nominal consideration of just £1. French investment firm Wendel agreed to buy London-based private equity rival IK Partners, which specialises in mid-market buyouts, for $404m and it was reported that CVC, Europe’s largest private equity manager which has €161bn under management and was valued at €15bn in a private transaction in 2021, was considering a listing in Amsterdam and the opportunity for its shareholders to sell down their stakes.

Elsewhere in the sector, it was confirmed that an agreement had been reached for Pension SuperFund to acquire STM Group, the AIM-listed independent provider of fiduciary and asset structuring services, for £35.6m with the transaction excluding STM Group’s SIPP business, which was instead sold to Pathline Holdings, an independent entity controlled by STM’s CEO. Waystone Group completed the acquisition of Link Fund Solutions, adding $190bn in assets under oversight and administration to Waystone, as well as 600 staff.

Another notable deal was announced. Our firm, IMAS Corporate Finance, was acquired by MarshBerry, an international financial advisory group specialising in wealth management and insurance distribution.

In the June edition of our M&A update, we commented that higher (nominal) interest rates were not impacting pricing or buyer appetite. Q3 2023 suggests this has indeed been the case, as deal volumes rose by 20% in Insurance and remained unchanged in the Investment sector, which accords with our own experience. Buyers have been trying to talk prices down but the keen competition for assets has not seen an actual tightening of the purse strings.

The peak of Insurance transaction volumes in Q1 2021 was driven by a concern that capital gains tax would increase significantly. It remains unclear why CGT fever did not infect the Investment sector, being perhaps more tax-savvy than the rest of us. With Labour’s lead in the polls, this concern may yet come to the fore, but we have seen no evidence of this.

We have recently completed a deal from heads of terms to completion in less than 13 weeks. In financial services this is breakneck speed and has only been possible with the FCA having recently significantly speeded up the granting of change in control permissions. Could it possibly be that robust deal volumes are a function of faster approval, rather than the underlying robustness of M&A as many deals are not announced until actual FCA approval has been received?

Looking back, 2022 will be seen as a quiet year in the Insurance space. Six more deals in Q4 2023 will see Insurance transactions in 2023 exceeding 2022. Activity in the Investment sector is the steady Eddy. But as we all know, investments can go up or down.

INSURANCE

September saw a marked uptick in UK Insurance M&A following a relatively quiet summer. Both the volume and value of M&A were up and the month saw the announcement of the sector’s largest deal of the year so far, by some margin.

The M&A headlines in the month were grabbed by the widely-expected announcement that Markerstudy has agreed to merge with Atlanta, the personal lines arm of Ardonagh, in a cash and shares transaction that values Atlanta at £1.2bn and will see Ardonagh become a major shareholder in Pollen Street backed Markerstudy, with the enlarged group transacting more than £3 billion GWP annually.

There were two other personal lines transactions in the month, with news that Arthur Gallagher has agreed to acquire Lifesure Group, a broker based in Cambridgeshire best known for its expertise in holiday and leisure business, and Aquiline-backed Ripe Thinking had made its first acquisition with Craftinsure, a specialist boat insurer that brings more than 20,000 new policyholders to Ripe, who are already active in the personal marine segment.

There was the usual flow of activity in commercial lines broking, with seven new deals to report on. The largest transaction in the month was the sale of Robin Plaster’s Norfolk-based One Broker Group to PE-backed consolidator Jensten Group, with the other six being towards the smaller end of the scale. Durham-based Castle Insurance (part of Brown & Brown (Europe), as Global Risk Partners has recently been rebranded) acquired local competitor Square Circle Brokers, Partners& added Hall Insurance Services in London, Greenwood Moreland (part of J.M. Glendinning Group) announced a deal for Calcluth & Sangster Insurance Brokers in Glasgow, and Clear Group announced no fewer than three new deals – Heath Crawford & Foster in Hertfordshire, Miles Archer in Kent, and Bluestone Insurance Services in Gloucestershire.

There was also continued M&A activity in the MGA segment, where 2023 will be a record year in terms of transaction volumes – indeed there have been more announced transactions in the first nine months of 2023 than there were in the whole of either 2021 or 2022. We will discuss the drivers behind this in our next annual review. There were three new deals to report on during September – iprism added SK Underwriting, Acrisure acquired Modus Underwriting, and Brown & Brown (Europe) announced a deal for Lloyd’s coverholder Occam Underwriting.

Finally, while this newsletter is generally dominated by M&A activity on the distribution side, as this is where the majority of deals are, we also focus on the carriers. In a major deal for the UK commercial insurance sector, it was announced during the month that Direct Line has agreed to divest its book of brokered commercial lines business, which includes the NIG, Churchill Expert and FarmWeb brands, to RSA Insurance, itself now part of Intact Financial Corporation, in a deal with an initial consideration of £520m.

INVESTMENT

Activity in the investment sector was frenetic in September, primarily driven by dealmaking in the wealth management sub-sector, including Caledonia Investments selling its majority stake in 7IM, the wealth manager and platform provider, to the Ontario Teachers’ Pension Plan for £255m. Wren Sterling announced it had increased its client assets by £400m via the acquisition of Bodmin-based Stockdale Group and Guildford-based Messer & Matthews. Mattioli Woods acquired Blackpool-based Opus Wealth Management, adding £53m in client assets, and Skerritts acquired Kent-based financial planning firm, Ambrose Fisher, adding £63m in AUM. Atomos purchased London-based IFA firm, Equanimity, while MWA Financial purchased London-based Sterling Financial Consultants and Cornwall-based The Financial Advice Centre. Perspective reached its 15th transaction for 2023, announcing the acquisition of Buckinghamshire-based Prosperity (GB), Northumberland-based AYP Financial Planning, and an undisclosed firm in the North. Söderberg & Partners also announced a trio of deals after acquiring Waverton’s majority stake in London-based Timothy James & Partners, providing the Nordic firm with access to £1.2bn of client assets, and minority stakes in Cambridge-based Dartington Wealth Management and London-based Atherton York. Foster Denovo acquired Newcastle-based Wade Financial, increasing client assets by £220m and One Four Nine purchased Lancashire-based 1st Chartered Financial Planning, which will be rebranded to One Four Nine Wealth. Edinburgh-based advice firm Chiene + Tait Financial Planning was also rebranded, becoming Seven Street Wealth after it was acquired by its management team. Dow Schofield Watts announced it had acquired Lancashire-based HNW tax adviser, STS Europe, and BRI Wealth Management expanded its footprint across the Midlands with the acquisition of Worcestershire-based Singular Financial Planning, adding £30m of AUA.

Elsewhere in the sector Aviva announced that it would acquire AIG’s UK protection business in a deal worth £460m, while Cooper Parry became the UK’s 11th largest accountancy firm after it purchased Haines Watts London. Nucleus’ £242m acquisition of Curtis Banks Group was cleared by the Competition and Markets Authority and savings and retirements firm, Phoenix Group, took a 5% minority stake in venture capital firm Hambro Perks. Investment manager Dowgate Wealth announced it had acquired the fund management teams and Asia funds of asset manager BambuBlack, while MPS provider Timeline secured £10m in its latest funding round from a consortium led by Blackfin Capital Partners. It was also reported by its co-owner, AssetCo, that Parmenion, the platform and investment management provider, had been the subject to a number of approaches to buy the business.

We routinely stress to potential clients the importance of taking external advice when they come to sell their business, as the buyer will (more often than not) be a fairly frequent acquirer and as such considerably more experienced at M&A than the seller.

But it is not only an issue of the specific advice one receives, but who is giving it and their own standing in the M&A marketplace.

On a current transaction, our client signed Heads of Agreement with a buyer and this contained a four-month exclusivity period, during which our client undertook not to engage in any discussions with other potential buyers. Protection like that is quite normal in deals of this size for a purchaser to commit to completing the deal.

Some two weeks later a new five-page exclusivity agreement from the buyer’s lawyers dropped into my inbox. I emailed the buyer saying our client had already signed an exclusivity as part of the HofT and that the new agreement was therefore both unnecessary and inappropriate. The response came back “it is now standard practice”. Not easy to argue against such a line given that exclusivity had already been agreed to, meaning our room for manoeuvre was restricted.

We responded saying of course we would sign the new exclusivity agreement. But adding that in the future IMAS would have to advise clients of this buyer’s excessively legalist approach to making transactions happen. Lo and behold, the buyer and their lawyers rapidly determined that the new exclusivity agreement was in fact not actually required.

We continue to use our leverage on behalf of clients throughout the sale negotiations and often this extends to some 2-3 years after completion, when earn-out payments become due. With the major shareholder of the acquired business often having retired, or about to retire, the ongoing management team can be reluctant to chivvy up the buyer (who is of course now their employer) into making the final payment or arguing a point. Our fee structure aligns us with the sellers, so we are directly incentivised to get involved and remind a buyer that their willingness to honour both the spirit and the letter of any earn-out is an important element in us being able to continue to recommend them as a quality buyer to the next client they might be relevant to.

Sellers advising themselves operate on a playing field that is tilted heavily against them. With a competent adviser that tilt is reduced. We believe our advice levels the playing field. Most buyers would admit that in fact we tilt it in favour of our clients.

Insurance

The summer lull in UK insurance M&A activity (announced basis) that we reported on July continued into August, with only eight new deals to report on this month, although as we noted last month, on a year-to-date basis the overall level of announced transactions is still running ahead of 2022. Deals in August were also mainly at the smaller end, with only one of the acquired businesses noted below employing more than 20 staff.

There was an above-average number of new transactions in the personal lines broking segment, with three new deals. Global Risk Partners announced that it had entered the pet insurance market with the acquisition of VetsMediCover, based in the West Midlands, with GRP noting that the acquired business will become part of its Insync Insurance business. In personal marine, Aston Lark (Howden) added to its existing platform (which includes Haven Knox-Johnston and Euromarine) with a deal for Curtis Marine, based in Portsmouth. In motor, Verex Insurance fell into administration during the month, with its business being acquired by Car Care Plan, part of AmTrust.

In commercial broking, there were four new deals to report on involving four of the ‘usual suspects’ as buyers. Ardonagh continued its recent run of new acquisitions in its Ardonagh Advisory segment with a deal for Sorvio Insurance Brokers in Salisbury. Partners& added NexGen Insurance Brokers in Kent. Seventeen Group acquired Mint Insurance Brokers in London (Mint was already an Appointed Representative of Seventeen’s James Hallam broking subsidiary). And Specialist Risk Group announced the acquisition of Cheshire Insurance Brokers, a broker with a particular expertise in arranging cover for recruitment agencies.

Finally, in the MGA segment, it was announced that bloodstock specialist David Ashby Underwriting has been acquired by Howden.

Investment

Deal flow announcements slowed during August as the holiday season was well underway. Nevertheless, several transactions involving financial advice firms were still announced, including Wren Sterling’s acquisition of Cornwall-based Stockdale & Co, and Evelyn Partners’ acquisition of Millen Capital. Two Nottingham-based advice firms were acquired during the month, with George Square purchasing rival firm Taylor McGill, adding a portfolio of 250 private clients and Progeny acquiring Fiscal Engineers, taking its AUA to £8bn. Loyal North increased its assets by £40m with the acquisition of Kent-based Paul Wallis Financial Solutions, while national advice firm LEBC went into administration and transferred its assets and personnel to the sister company, Aspira.

Among the IFA networks, Tenet announced its closure and appointed representatives were offered the chance to move to the Openwork Partnership, which could potentially see Tenet’s 170 firms, 360 advisers and £6bn of client assets transferring to Openwork. In a separate transaction, Tenet’s mortgage arm, TenetLime, which has 231 mortgage and protection advisers and 133 appointed representatives, was acquired by LSL Property Services in a deal worth £12.9m.

Elsewhere in the sector, Co-op Bank acquired Sainsburys’ mortgage portfolio, adding 3.5k clients and balances totalling £479m and Dark Star Asset Management acquired GWM London, the UK arm of a Swiss multi-family office.

Since January 2021 more than half of all announced transactions in the UK in the general insurance and investment sectors with a value between £5m and £25m have been done on an unadvised basis.

Buyers devote considerable effort in trying to secure off-market (i.e. unadvised) deals although they will readily admit that such processes typically take longer and are more difficult for both sides, whilst leaving money on table, they can get bogged down in the detail and often be aided and abetted by their own lawyers.

So why the effort and extra grief? Simply put, unadvised transactions are cheaper for the buyer, as competitive tension is absent.

The very thing we look to create is competitive tension. We do this by ensuring our client is well prepared and only engaging with those potential buyers who have both a heathy appetite and a cheque book commensurate to the task in hand.

One weapon in the arsenal of a buyer seeking out unadvised targets is the somewhat innocent sounding “mutual NDA”. In signing this document an owner considering a sale typically agrees not to engage with any other party for an extended period whilst handing over far more information than is necessary to the author of the NDA.

We have been talking to one particular client for over a year, about when it will be the right time to sell in terms of his personal objectives, about likely values, about how long any earn-out will be, the basis of calculation, and so forth. Getting ready to engage with potential buyers.

Last week a “mate” of the business owner helped him set up a meeting with a serial buyer and the following day he was (predictably) being pressed to sign an NDA, with absolutely no sense of what the deal on the table might be.

Signing NDAs is a normal part of commercial life. When we engage with prospective buyers on behalf of a client, we ensure non-disclosure undertakings are given by the buyer and include very specific protections for the seller, not vice versa, as the buyer will not be the one disclosing details of their clients or top producers.

We would only ever suggest a seller grant a buyer exclusivity at the end of detailed pricing negotiations when the shape and value of the deal is clear, not at the start.

Taking advice puts you in control, ensuring you are positioned to achieve the best deal – and this is about more than just a headline price. You only sell once, it is important to get it right.

Insurance

July has seen a modest slowdown of UK Insurance M&A activity, with only 9 new deals to report on this month, but deal volumes continue to be at near record levels.

As readers of our annual review documents will know, for some time IMAS has been reporting on the near drying up of new direct and primary investments into the insurance distribution sector by private equity, with only two such transactions during the whole of 2022. Well, like London buses, in July we saw two such investments announced within days of each other. In the first, mid-market PE firm Blixt Group announced that it had invested in Academy Insurance Services, working alongside a new management team with previous experience at Swinton. In the second, fast-growing MGA Carbon Underwriting announced that it had received new investment from Apiary Capital.

The Carbon deal was one of no less than four new MGA deals announced during July, where the M&A market remains very active (there have been 16 MGA deals so far in 2023, versus only 13 during the whole of 2022). Two of those deals involved Clear Group, which announced the acquisition of both PI specialist One Commercial Specialty from BSpoke Group, and a few days later, a deal for Profile Risk Solutions, which trades as Profile Underwriting. In the fourth MGA deal, NBS Underwriting announced it had acquired Capital Markets Underwriting, or CMU.

There was the usual clutch of new commercial broking deals in the month, with serial buyers Global Risk Partners (via its Greens hub business) announcing a deal for Petherwick Insurance Brokers in Sussex, and Ardonagh continuing its recent run of new UK deals with AMS Insurance Solutions in Somerset. At the smaller end, Stevenson Seacombe Partnership announced that it had acquired a 51% interest in fellow TBIG member Whitefield Insurance Services.

Amongst carriers it was announced that German legal expenses specialist ARAG will acquire the UK business of competitor DAS Legal Expenses.

At 31 July on a YTD basis there had been 90 announced insurance distribution M&A deals in the year, versus only 63 in the corresponding period in 2022. Activity is tracking close to the record set in 2021, when 95 transactions were announced in the first 7 months of the year.

What transaction volumes disguise however, is the reducing size of the deals being done, as supply-side constraints force the mainstream consolidators into targeting smaller and smaller deals. The average and median headcount of acquired businesses in the 90 announced deals in 2023 (YTD) is 28 and 13 respectively. In the 95 deals announced in the same period in 2021 the mean and median headcount across all targets was 77 and 18, respectively.

Investment

July included a number of transactions involving public companies in the investment sector. First came the announcement of a £500m investment by Chetwood Financial in LendInvest, the mortgage platform provider. Then STM Group, the international administrator of wealth assets, announced that they had reached an agreement in principle on the key terms of a possible £44m cash offer from Pension SuperFund Capital. And finally, asset manager Gresham House, which manages £8bn of assets, announced it had agreed a £470m takeover offer from US private equity firm Searchlight Capital, representing a 63% premium to the group’s shares closing price the week before.

In the meantime, there was continuing high levels of activity in the wealth management sector, including Fairstone’s acquisition of West Midlands-based Prosperity Wealth, with £1.5bn AUM, and Benchmark Capital’s acquisition of Swindon-based Unique Financial Planning, with £755m of AUA. HMFC Wealth acquired London-based Weston Cummins, with £350m of AUA, and Ascot Lloyd bought Swansea-based Portfolio Financial Consultancy, with £323m of AUM. One Four Nine announced the acquisition of Plymouth-based Rainbird & Co, increasing its client assets to £1.4bn, while Lumin Wealth added £85m to its AUM with the acquisition of Essex-based The Big Picture Wealth Management. Investment management group, Marlborough Group, took a minority shareholding in advice firm, Truly Independent, which advises on £1.5bn of client assets. It was also rumoured that Close Brothers Group is exploring the sale of its wealth management division, Close Brothers Asset Management.

Elsewhere in the sector, Defaqto expanded its investment research capabilities with the acquisition of MI Capital Research, and Abrdn Smaller Companies Income announced its merger with Shires Income. Pension administrator Smart Pensions increased its AUA to £4bn with the acquisition of Evolve Pensions, and LifeSearch, the independent protection specialist, announced it had partnered with Neilson Financial Services, a globally focused provider of life insurance, becoming its exclusive advisory arm.

M&A volumes (announced basis) in UK Financial Services during Q2 were slightly ahead of Q1 2023 in both the General Insurance and Investment sectors. However, one has to be cautious about what these statistics say about market conditions today, for two reasons. Firstly, M&A is a bit like London buses (of old). One could wait for some time only to have three come along at once. Secondly – and more importantly – announced deals are a lagging indicator. Deals announced today reflect transactions agreed upon typically some 6 to 12 months ago.

Conditions have of course changed as the era of very low interest rates has gone and more broadly consumers face increasing pressures on the cost of living. That said, UK real interest rates are still negative (actual interest rate less inflation); this offers little immediate comfort to consumers, or those lending to them.

In the investment sector M&A volumes in 2023 YTD were very similar to those seen in 2022. Looking forward, activity remains robust and headline deal prices remain largely unchanged. The higher financing costs and risk of a recession/fall in equity valuations has resulted in more transactional risk being shouldered by sellers, with the earn-out elements increasing. Ongoing fee pressures encourage many trade buyers to look to replace organic growth with acquisitions. This same pressure means potential targets recognise that their value may be unlikely to increase much over the short to medium term, accelerating the decision to sell.

The experience of the Insurance industry is somewhat different. Scarce and costlier capital tends to push up rates, increasing commission-based earnings on the distribution side. Unlike saving, the majority of insurance expenditure – by companies and individuals – is non-discretionary and so short of a deep recession, industry revenues are robust. Most clients also pay upfront, so the industry typically has large cash balances to act as a nature hedge. Demand for targets is still outstripping supply and with highly predictable earnings, if anything we have recently seen purchasers willing to pay higher amounts upfront to secure acquisitions.

Valuations in many segments of the UK financial services sector remain near all-time highs. In part we have the FCA to thank for this. A demanding approval process and increased regulation creates a significant barrier to entry, pushing up the value of existing entities. Eventually interest rates are likely to fall back again. There is no suggestion that the FCA is looking to open any flood gate.

We are always happy to talk to clients thinking of selling, about macro issues or the details of their own businesses.

Insurance

When I wrote the first draft of this newsletter on Monday, the story was one of UK Insurance M&A activity beginning to slow as we got into summer, as at that point we had only eight new transactions to report on. However, over the course of the past five days there has been a flurry of newly announced deals (which we count as June) and that figure has doubled, suggesting that there has been no let-up in the frenetic pace of sector M&A we are seeing in 2023.

June’s transactions were all on the distribution side, with 15 broking deals and one acquisition of a network. Several of the ‘usual suspects’ on the buyside were active and indeed four different buyers announced more than one deal during the month. June’s deals were all also relatively small, with no transaction valued at above £25m during the month (based on IMAS estimates).

In the most high-profile transaction of the month, US group Acrisure became the latest consolidator to have an owned network proposition with the acquisition TEn Insurance Services, which it has announced it will rebrand as Eleven Network (geddit? It’s one louder).

In broking, J.M. Glendinning continued its busy 2023 (it is the most active UK buyer YTD based on number of announced deals) with two new announced transactions, adding G R Marshall & Co in Southampton and Blackfriars Group in Cheshire. Ardonagh also announced two new UK deals, adding York-headquartered PB Curran and self-drive hire specialist Sentinel Insurance Solutions in Reading. Both will sit within the Ethos Broking segment of the group. Global Risk Partners acquired both Amicus Insurance Solutions in Surrey and KPTI (trading as IS Insurance Solutions) in London. Finally, Clear Group also added a brace, announcing deals for MJB Finningley in Amersham and Mayor Broking in Doncaster, both small deals and conveniently located close to existing Clear offices.

Elsewhere amongst the mainstream broking consolidators (none of whom ever thank me for describing them as such…), AssuredPartners added recycling specialist GM Insurance Brokers in Exeter, Howden announced a deal for Film & TV specialist Media Insurance Brokers International, Jensten Group added Simpson and Parsons in the Lake District, and Partners& continued to build out its presence in Scotland with the acquisition of Hart Insurance Brokers in Helensburgh.

Among the less frequent buyers, Australian group PSC Insurance was revealed in Companies House filings to have acquired commercial broker Turner Rawlinson & Company in London, in an unannounced transaction that actually completed in the Spring.

Lastly in commercial broking, Peter Cullum’s The Broker Investment Group was reported to have bought out Hallsdale Insurance Brokers in Kettering, a business in which it already owned a minority stake.

In personal lines, Kingfisher Insurance announced that it had acquired the business of REIS Motorsport Insurance, a specialist broker that has previously been part of the Markerstudy group, who had acquired the business from Chaucer in 2015.

Investment

M&A activity in the investment sector did not slow during June, with another strong month of deals particularly in the wealth management sector, including Evelyn’s acquisitions of Dart Capital, adding £739m of AUM, and Glasgow-based PPM Wealth, expanding Evelyn’s footprint further in Scotland. Adviser Services Holdings Limited announced two further additions to its national advice business, Lync Wealth Management with the acquisition of Friarsgate Financial Planning (Chester) and Richard Armitage Wealth Management South West, increasing AUM by £200m. Tyron Edmonds, the former CFO of St James’s Place partner firm, Morrison Wealth, acquired Jackson Hodge Wealth. Perspective Financial Group increased its AUM by £310m with another streak of acquisitions, purchasing Brighter Financial Services in Halifax, Airedale Personal Financial Solutions in Holmer Green, Granite Coast in Cambridge and Brigham Wealth Management in Harrogate, marking twelve acquisitions for the company in 2023. Shawbrook-funded advice network, Corbel Partners, with over £2bn AUM, acquired Midlands-based Wealth Design Holdings. Jersey-based asset manager, Team Plc, announced the acquisition of Isle of Man-based Thornton Chartered Financial Planning, increasing its AUM by £120m, and UAE-based Globaleye Wealth Management, increasing its AUA by £242m.

Dealmaking elsewhere in the sector included Lumin Wealth taking a majority stake in specialist mortgage adviser Davidson Deem and Shawbrook Group acquiring specialist lender Bluestone Mortgages. Titan Wealth purchased investment research and consultancy firm, Square Mile, increasing its headcount by 21 research analysts and an investment management team responsible for £2.6bn MPS solutions. Fintel, the parent of Defaqto and SimplyBiz, took a 25% stake in Plannr Technologies, a financial planning CRM business, and BlackRock, through its Aladdin Wealth business, acquired a minority stake in Swiss banking software maker, Avaloq.

Activity in the asset management sector included Man Group taking a 51% stake in ESG boutique Asteria, and Switzerland-based GAM selling its loss-making fund services business to Dublin-based Carne Group, as well as Pacific Asset Management announcing a joint venture with Australian bond boutique Coolabah Capital. BlackRock announced a further acquisition during June, the acquisition of London-based private debt manager, Kreos Capital. Dual-listed Investec furthered the trend of consolidation in the investment banking industry by doubling its stake in European boutique adviser, Capitalmind Group, to 60%.

Are we at IMAS about to be replaced by Artificial Intelligence? I asked ChatGPT “Is selling your business stressful?” It raised six points in response. The first was “Emotional attachment: As a business owner, you may have invested a significant amount of time, effort, and passion into building your business. Letting go and separating your personal identity from the business can be emotionally challenging.” It concluded with “Engaging with professionals like business brokers, attorneys, and accountants can help alleviate some of the stress by guiding you through the process and ensuring a smoother transaction.” Pretty good really – we’ve been saying similar things in this newsletter for many years.

When I enquired about who should buy a particular type of business ChatGPT’s advice was very broad and as a result unhelpful. Asked to choose between two buyers the advice was similar to how the curate commented on his egg. Not the unambiguous advice our clients are looking for. So, for the moment I am not expecting to receive my P45.

However, ChatGPT is absolutely correct about the importance of a smooth transaction. Most transactions involving privately owned financial services companies involve an earn-out. Disputes, typically over minor matters, or misunderstandings can sour ongoing working relationships. Clients in the past have become upset about the cost of making dilapidation provisions in a sale contract that represent less than 0.1% of the value of the upfront payment they are receiving for the business. Perhaps an underbidder in the same process could have taken a different approach, but if their offer was 10% less than the winning party, then the 0.1% is just a rounding difference.

Lawyers are vital to a sale process but can increase stress levels by raising issues that may be technically correct, but commercially wide off the mark. This ranges from informing clients that “earn-outs never work” (our experience is quite different – good buyers are only too keen to ensure they do) to raising – completely misguided – concerns about a particular buyer’s solvency and associated credit risk in the example I am thinking about the purchaser was listed on the NYSE with a market capitalisation of more than $10bn.

An important part of our role is to keep everybody focused on the key commercial issues and give highly specific advice based on the specifics of each transaction.

Selling a business is a life changing event for most vendors, so it is bound to be highly stressful. But that stress has to be managed so it does not undermine the transaction itself.

Part of ensuring that a sale process runs smoothly is to prepare for it. Consequently, we are always delighted to engage with owners long before an actual sale is envisaged. We look forward to hearing from you.

Insurance

Following a very active March and April, there was a marked reduction in the number of newly announced M&A deals in UK insurance during May, albeit with one major new transaction taking place and several smaller deals to report on across the broking and MGA segments.

The headline grabbing deal during the month was of course the acquisition of Kentro Capital (which comprises MGA platform Nexus and credit specialist Xenia) by Brown & Brown, the US-listed group that also owns Global Risk Partners. The transaction, with a value of just under £400 million, marks another major acquisition of a UK business by a US buyer, a continuing trend that IMAS has been reporting on extensively over the past couple of years.

In another MGA deal in the month, Bspoke Group (which comprises the old UK General and Precision Partnership) announced its first acquisition since it received private equity backing from RCapital last October, adding Miramar Underwriting, an MGA based in London and writing mainly property classes of business.

As usual, there were a number of new add-on deals announced by several of the ‘usual suspects’ in commercial broking. Specialist Risk Group added TLO Risk Services, a broker specialising on serving the legal profession. US group AssuredPartners announced a deal for InEvexco, a specialist in Kent focused on insurance for events, exhibitions, and conferences. J.M. Glendinning announced its 20th deal since 2020, adding Insure Business Services in Newcastle. And Jensten Group acquired Coversure Poole, an existing franchisee.

While the major consolidators are heavily focused on deals for control, there are still alternatives for sellers seeking only a partial sale. During the month The Broker Investment Group, the vehicle chaired by Peter Cullum, announced a new minority investment (49%) into Mayfair Insurance & Mortgage Consultants, a broker in Bedford.

IMAS makes every effort to capture and report on every relevant transaction in the segment as they happen. Indeed, we have proprietary technology that helps us do this. Most sector deals are publicly announced and picked up in the trade press. But not all of them. Some buyers like to keep under the radar, but of course still need to make relevant filings with Companies House. So here’s a little scoop. Inflexion-backed DR&P Group has been on a recent roll, with three new (unannounced) transactions during March and April. They have done deals with Berry Insurance Brokers in Preston, Radius (I.B.) in Hull, and Sector Associates in Thirsk, collectively adding more than 30 new staff to the group.

Investment

M&A activity in the Investment sector in May was largely driven by continued consolidation in the wealth management sector, including Hurst Point Group’s acquisition of Helm Godfrey, adding £1.0bn in AUM and £0.5bn in AUA, and Titan Wealth’s acquisition of Ravencroft’s UK-based investment management business with £600m of AUM. Private equity firm Foresight Group invested £6.7m in Manchester-based Five Wealth, which has £670m of AUA, to support equity release for existing shareholders and provide additional growth capital and Fairstone increased its AUA by £450m with the acquisition of Essex-based Sacre Associates. Perspective Financial acquired four firms, namely, Tees Valley Asset Management, P Bennett & Associates, Oak Financial Management and Marlborough Place, expanding its presence in Northern Ireland, and bringing its total acquisitions in 2023 to eight. Wren Sterling also expanded into Northern Ireland with the purchase of Ralston Bennett Financial Planning and its appointed representative business, Aspects Financial, both based in County Down, as well as the acquisition of St Helens-based Callisto Wealth. There was also further activity in Scotland, with Succession Wealth acquiring Edinburgh-based Spence & Spence, increasing its AUA by £170m, and Gilson Gray Financial Management purchasing Dundee-based Wilson Financial, marking its fourth deal in the last 12 months.

Elsewhere in the sector, London-listed investment trust Civitas Social Housing agreed to a £485m all-cash offer by CK Asset Holdings and Lansdowne Partners acquired fellow London-based asset manager Crux Asset Management, adding £1bn in AUM. Private equity firm Sovereign Capital Partners announced the acquisition of a majority stake in chartered accountancy and financial advisory firm LB Group and London-based savings and investment technology platform, Smart, raised £75m in a Series E fundraise led by Aquiline Capital Partners.

Clients often come to us hoping to find “certainty” around a range of issues and questions: Who will buy my business? How much will they pay? What will the deal structure look like? How long will it take? Who do I tell internally about a sale and when? Will capital gains taxes rise?

The advice we give is based on 20 years of experience and relationships that are constantly being refined by other current discussions we are having in our chosen area of expertise, advising on the sales of financial services companies.

However, we don’t have a crystal ball and the future consistently confounds predictions. Clients also have very different attitudes to paying tax. This can range from a resigned acceptance of the two inevitabilities in life – death and taxes – to a steely determination that as little as humanly possible of 30 years of work should be shared with Jeremy Hunt.

But we can offer two insights. Firstly, the fear that capital gains tax rates were going to rise in March 2021 (they did not) saw a rush of vendors looking to exit before the budget. In their haste they typically did not take advice and sold for less than what would have been achievable with a more measured (advised) approach.

Secondly, vendors typically have quite unrealistic expectations around how long it takes to transact. This is understandable given that, in one-to-one discussions, acquirers will happily tell the vendors what they want to hear. If they don’t, somebody else will and they may lose out on the opportunity.

“It will be done in three months”. By the time the vendor realises this is a hopelessly unrealistic timeframe they are too far in to pull out.

So how long does it take? With not a bump in the road and a dollop of good luck one is generally still looking at 6 months as a minimum. Financial services is a regulated sector. Due diligence is a demanding process. And most transactions cannot be completed without FCA approval. Due diligence also has a nasty habit of bringing up unforeseen issues that whilst solvable, take time to resolve. If you want to be cautious, we advise clients to plan for a process to take 12 months from start to finish. If one wants to be as certain as one can be of hitting a deadline, 15 months should allow for bumps and mishaps on the journey.

If you want to understand the issues around sale, we are always delighted to advise on any aspect of a transaction – other than what a future Chancellor might do.

Insurance

April was another busy month for UK Insurance sector M&A, with 16 new deals to report on and no fewer than eight of the active consolidators announcing one or more new acquisitions across the broking and MGA segments.

As always, the majority of activity was in commercial lines broking. PIB Group, which has recently been more active in overseas M&A than domestically, announced two new deals in the month, adding Bristol-based PI broker Pure Risks and property specialist St Giles, including St Luke Underwriting. Global Risk Partners announced a deal for Thompson & Co. (Risk Solutions) in the West Midlands. Partners& added Richard Thompson Insurance Brokers in Weybridge. Greenwood Moreland, the acquisitive Scottish broker owned by J.M. Glendinning added Gordon Blyth Insurance Brokers in Paisley. The Needham Group announced that it had acquired P J Insurance Brokers, adding £2.5m of GWP, and FR Ball announced that it had acquired Export & General Insurance Services in London.

Also in commercial lines, two of the more recent US buyers in the UK market announced new deals. NFP added Gravity Risk Services, a community broker in the West Midlands, and AssuredPartners, via PSP Group, consolidated its leading position in the South West of the country with two new acquisitions, Sterling Select Insurance Services and Castle Sundborn.

In personal lines, Ardonagh announced deals for HNWI specialist Stanhope Cooper, as well as associated MGA Renovation Underwriting, which provides insurance for private client contract works and high-value projects. Insurer Direct Line announced that it had agreed to acquire By Miles Group, a technology-led MGA providing of pay-by-mile motor insurance, adding c.£26m of GWP. In the largest sector M&A deal of 2023 to date, pet insurance business Animal Friends was acquired by Pinnacle Pet Group, a pan-European pet insurance provider backed by JAB Holding. Commercial Insurance Services (which trades as CiSL) also announced that it had acquired the insurance broking division of Grayside Financial Services (which is part of Fairstone) in Surrey.

Finally, Specialist Risk Group continued its recent run of new deals with the announcement that it has agreed to acquire The Medical Professional Liability Company (MPLC), an MGA and Lloyd’s coverholder that provides medical professional liability insurance and reinsurance.

Investment

April was a busy month for M&A activity in the investment sector, highlighted by three high profile transactions. First came the announcement of Rathbones’s £839m acquisition of Investec Wealth & Investment, creating a leading wealth management group with over £100bn of client assets. Then came Deutsche Bank’s £410m public offer for UK broker and investment bank Numis, which advises almost a fifth of companies in the FTSE 350 index. In the meantime, it was reported that fund manager Liontrust was pursuing the Swiss fund group GAM. A £96m deal was indeed agreed earlier this week to form an international asset manager overseeing £53bn.

Several other deals were announced in the wealth management sector. Irwin Mitchell Asset Management increased its AUM to £1.2bn with the acquisition of Leeds-based wealth manager Andrew Gwynne. Gilson Gray Financial Management acquired Fife-based SJP partner firm, RS Robertson Financial Planning, taking its AUM to over £650m. Adviser Services Holdings Limited launched its advice business, Lync Wealth Management, with the acquisitions of Sheffield-based Sheafmoor Money Management and Belfast-based North Financial Management. Liverpool-based CAM Wealth Group was formed with the buyout of London-based Charteris Asset Management by Derek Gawne and Lizz Ewart. Holborn Financial announced the acquisitions of Whitchurch-based Kingsley Financial Management and Maidstone-based Gary Cook Financial Services. Clifton Asset Management increased its AUM to £1.2bn by adding 550 clients with the acquisition of Wombourne-based GB Financial Services. Mattioli Woods acquired Doherty Pension & Investment Consultancy in Northern Ireland for £15m and Apollo Private Wealth increased its AUM to £300m with the acquisition of fellow SJP firm Debra Wait Wealth Management. Antrams Financial Services and Pembroke Financial Services announced their merger, creating a combined firm with £1.5bn of client assets.

There was also activity elsewhere in the sector with Momentum Global Investment Management’s acquisition of the £2.3bn fixed income and multi-asset investment specialist, Crown Agents Investment Management, and Royal London’s acquisition of Aegon’s individual protection book. It was rumoured that buyout firm Inflexion was planning a £400m bid for Caledonia-backed investment and wealth manager 7IM. Mattioli Woods completed a second acquisition in April, with a majority 50.1% stake in Lincoln-based mortgage broker, White Mortgages. London-based digital mortgage platform, Tembo, raised £5m from a consortium consisting of its existing investors, Aviva Ventures and Ascension Ventures, as well as Lone Ventures and Starling Bank backer, the McPike family office. Bagnor-based insurance and protection business, Precise Protect, was acquired for £7m by London-listed investment group Tavistock Investments. Evelyn Partners completed its second professional services acquisition of the year with the addition of Cambridge-based accountancy and tax specialist, Ashcroft Partnership.

IMAS has tracked announced M&A activity across General Insurance and Investment, two key sectors in UK financial services, for many years. The charts above and below show the volume of transactions by quarter since 2020.

Q1 2023 was broadly in line with the levels of activity seen during 2022, and some way below the record-breaking year of 2021.

The question we are frequently being asked is whether increasing interest rates and the general uncertainly around the UK economy have impacted transaction volumes, and perhaps more importantly, deal pricing?

It typically takes several months from agreeing the headline terms of a deal to actually transacting. The prices of deals being signed and announced today are often a function of decisions taken some six months or even longer ago. Serial buyers, keen to protect their reputations, are naturally reluctant to chip the price during negotiations, despite the increased pressures that many are now facing. A sharp deterioration in market sentiment might remove this inhibition, but this has – based on our experience – so far not occurred.

Insurance

March saw another steady stream of new UK Insurance sector transactions being announced to end a quarter that has seen an above-average level of M&A activity (all deals – note that charts shown in this newsletter are for deals valued at >£5m only). If you are interested in reading more about longer term M&A trends in the sector, our fourth annual UK Insurance Distribution M&A Annual Review was published during the month and can be downloaded here.

As usual, commercial broking led the way in terms of new transaction announcements. Among the more frequent acquirers, J.M. Glendinning Group announced that it had acquired HGV and motor trade specialist New Era Insurance Services in Stoke-on-Trent, which in turn announced its own new deal, adding Inspire Road Risks (trading as courierinsurance. co.uk). Specialist Risk Group added Consort Insurance in Essex, Ardonagh announced a deal for Compass network member Pace Ward in Stoke-on-Trent, GRP-owned Castle Insurance Services added M R Lonsdale & Partners in Durham, and AssuredPartners continued its expansion in the South West with the acquisition of SouthWest Brokers, which trades as Westinsure Plymouth.

Arthur Gallagher was also active during the month, bolstering its leading position in the education sector with the acquisition of FE Protect, a specialist broker focused on the Further Education college segment and based in Formby. Arthur Gallagher separately announced the acquisition of Bay Risk Services, a binder broker in the Lloyd’s and international market, from Optio Group, and the group’s underwriting arm Pen Underwriting added Tay River Holdings, a specialist MGA in marine classes, adding £90 million of GWP.

Away from the ‘usual suspects’, it was reported that private client broker Castleacre Insurance in Suffolk had acquired Merritt Insurance Services in London, and it was announced that London market broker Ballantyne Brokers had undergone an MBO, coming out of US-based K2 Insurance Services.

In the first private equity exit from a UK sector investment of 2023, it was announced that Dunedin-backed Acquis Insurance, which specialises in serving the asset finance industry, has been acquired by NSM Insurance Group. NSM owns several UK businesses including Kingsbridge, which it also acquired from Dunedin, in 2020.

Finally, again in commercial broking, in its annual results for 2022 Ecclesiastical Insurance revealed that in December 2022 its Benefact Broking arm had sold SEIB Insurance Brokers to Lloyd & Whyte. Benefact is already a large minority shareholder in Lloyd & Whyte and the deal increases Benefact’s shareholding in the business, as it gradually moves towards a controlling position.

Investment

The strong deal activity continued in March, primarily driven by several notable IFA transactions. Progeny announced plans to buy chartered financial planning firm Gibbs Denley, extending its national footprint to East Anglia and taking AUM to more than £7.5bn. Fairstone marked its second IFA purchase of the year with Spalding-based advice firm, MT Financial Management, adding £200m to its AUM. Craven Street Wealth boosted its AUM to £1.25bn with the acquisition of London-based Bernard Barrett Associates. Advanta Solutions announced its sixth acquisition in the last 18 months with the purchase of Hertford-based MW Wealth Management, adding £65m in AUM. Perspective completed a hattrick of IFA purchases in March adding £515m in AUM, with the addition of HNH Financial Services, Gould Financial Planning, and Financial Choices IFA, expanding its presence in Huddersfield, Cardiff and Whitstable, respectively. Schroders-owned Benchmark Capital completed its second acquisition in Northern Ireland with the purchase of Kennedy Independent Financial, adding £80m in AUM and further progressing the firm’s plan to build a hub in Derry. Wren Sterling also injected £80m into its AUM with the acquisition of Glasgow-based Active Wealth Management.

There was activity elsewhere in the sector, with AssetCo’s acquisition of Ocean Dial Asset Management for £4.1m, and First Sentier’s majority stake in London-based Credit Manager AlbaCore Capital Group. Marwyn Capital formed Marwyn Acquisition Company II, a vehicle setup to seek out deals with financial advisers, wealth managers, fintech firms and life and pensions companies. Furthermore, there were several reports speculating that Australia-based Macquarie Group is considering a £5bn takeover of London-listed asset manager M&G. Kingswood confirmed that it is considering the sale of its UK business, with a potential value of £250m.

March marked a tumultuous period for the banking subsector, with the fallout of Silicon Valley Bank leading to HSBC acquiring the UK arm for £1, and UBS rescuing Credit Suisse for $3.25bn. It was also reported that Barings is to acquire Australia-based Gryphon Capital Partners, the parent company of Gryphon Capital Investments. The plans to sell the fund administrator, Link Fund Solutions, is in doubt after a senior management crisis at the bidding firm Waystone Group.

IMAS has advised on four announced UK M&A deals since the New Year and, touching a large piece of wood, expects more to follow shortly.

For most of our clients employing us seemed like a big step. Can selling a business really be that complicated? Without exceptions our clients are highly appreciative of what we do for them. In part this is because the actual process is far more complex than they ever anticipated at the outset.

Complications invariably arise. Timetables have to move. And there are some factors that are out of everybody’s control. One of our transactions, yet to be announced, received FCA approval for the change of control within three weeks of making the application, but another has been waiting well over three months for the same thing, with no real sense of when it might come through.

Sellers see headline numbers, but the reality is that different buyers offer very different structures that can make comparisons complex. More importantly sellers may unwittingly seek mutually exclusive outcomes from a transaction.

Two weeks ago, we talked to a major US consolidator looking to enter the UK for the first time. As they have no “boots on the ground” here, a central tenet of their proposition is that the management of any business they acquired would have to remain in place and continue to hold a meaningful stake.

Owner/managers looking to sell out in full and then make a relatively rapid exit should understand that this would almost certainly preclude such a new entrant, who would never be the right buyer for their business.

Selling involves trade-offs. A quality adviser who understands the industry will articulate these so you can make appropriate and informed decisions as the process goes from stage to stage. If you are told you can have your cake and eat it, you are being poorly advised.

We are always happy to meet to discuss how to maximise value, but also to help explain some of the possible trade-offs clients should consider to meet their objectives most effectively.

Insurance

February was a relatively lively month for UK insurance M&A, with ten new announced deals to report on involving a number of medium sized targets and several smaller deals in the distribution segment.

As with most months, Global Risk Partners were again active, announcing the acquisition of Shropshire-based commercial broker Henshalls Group and, via group company Hamilton Fraser, adding Edmondsons, a London-based broker specialising in property and legal indemnity insurance.

Elsewhere amongst the ‘usual suspects’, Aston Lark (now of course part of Howden) announced that it had acquired Allegiance Insure in London, and Howden announced that it had acquired Reich Insurance Group in Manchester, and in a separate transaction, both the bloodstock broking team and MGA Galileo Underwriting from AUB-owned Tysers.

J.M. Glendinning was also (indirectly) active, with its Scottish subsidiary Greenwood Moreland announcing that it had taken over the business of Kingdom Insurance Services in Fife. Clear Group announced that it had acquired another member of its owned Brokerbility network with a deal for IFM Insurance Brokers in Sheffield, and Jensten Group continued its recent string of acquisitions with Darwin Clayton, a schemes broker based in Tunbridge Wells.

Amongst the less well-frequent acquirers, BEAM Insurance (a trading name of JPM Insurance) in the West Midlands acquired Andrew Phillips Insurance Brokers (AP Insurance Brokers) in Redditch, and Specialty MGA UK added ForestRe, an MGA focused on the global commercial forestry sector.

Investment

The investment sector saw plenty of M&A news in February, driven by high-profile announcements including NatWest’s £144m acquisition of a majority (85%) stake in workplace savings and pensions fintech business, Cushon, and Liechtenstein-based LGT’s £140m acquisition of Abrdn’s DFM business, Abrdn Capital. It was also reported that Santander is in discussions with Abrdn to acquire its private equity arm.