|

Filter M&A Reviews:

Sign up to our monthly M&A Review emailFull Review

Insurance

December saw a continuation of the recent steady flow of announced UK Insurance M&A, with noteworthy deals across both distribution and risk businesses. The first week of the New Year has also seen a number of notable announcements of deals that will have been signed at the year end and so are included here.

Starting with insurance broking, activity was as ever dominated by the private equity backed consolidators. PIB Group announced its largest deal to date, acquiring specialist landlord insurance and tenant referencing business Barbon Insurance Group, a fellow Carlyle portfolio company. Global Risk Partners announced it has acquired Poole-based online commercial broker Insync Insurance Solutions, and Tasker Insurance Brokers acquired Numark Insurance Services, bringing it an affinity relationship with Numark network of independent pharmacies. A further three consolidator deals were announced in the first week of January, with Aston Lark acquiring superyacht specialist and Lloyd’s broker CRS Yachts, Phil Barton’s Partners& adding Focus Oxford Risk Management, and Specialist Risk Group announcing that it had acquired KBIS, the specialist equestrian insurance business.

One of the consolidators was itself acquired during the month, with Specialist Risk Group (SRG), the owner of Miles Smith that has been backed by Pollen Street Capital since late 2017, getting a new private backer. HGGC, the Palo Alto-based firm that also owns acquisitive insurance services business Davies Group, has replaced Pollen Street to support the next stage of SRG’s growth.

Finally, Geo Underwriting, the MGA arm of Ardonagh, announced its fourth deal of 2020 with the acquisition of Robus, an advisory firm specialising in insurance management, protected cells and captive management, with operations in Guernsey, Gibraltar and Malta.

In the sole broking deal that did not involve a PE-backed consolidator, Altrincham-based brokers Alan Stevenson Partnership and Seacombe Insurance Brokers announced that they were to merge, with a simultaneous minority investment in the combined business being made by Ataraxia and Minority Venture Partners (MVP), two investment vehicles backed by Peter Cullum.

Outside broking, there were two insurer deals involving legacy / run-off specialists, where 2020 has seen a high level of M&A activity. Randall & Quilter announced that it had acquired the Vibe Group companies Vibe Services Management Limited, Vibe Corporate Member Limited, and Vibe Syndicate Management Limited, thereby taking over responsibility for the run-off of syndicate 5678. Separately, RiverStone Europe, the European arm of Farifax Financial’s global run-off business RiverStone, was acquired by PE firm CVC Capital Partners (through its Strategic Opportunities Fund II) in a deal valued at $750m.

Lastly, just a few weeks after the listed price comparison business GoCompare was subject to a takeover offer from publishing group Future plc, motor insurer Admiral Group announced that, alongside its partner MAPFRE, it was divesting its price comparison division, which includes Confused.com, as well as its European comparison businesses Rastreator and LeLynx, to property website business Zoopla Property Group, the owner of uSwitch.

Investment

Mutual insurer LV= agreed to sell its savings, retirement and protection businesses to Bain Capital Credit for £530m in a process that attracted 12 bids from a mixture of private equity and trade buyers. The transaction marks the demutualisation of one of the UK’s largest mutuals under which its members will receive a cash payment to compensate for loss of membership.

Following last month’s news in relation to Parmenion and Nucleus, the investment platform market continued to attract attention with AnaCap signing a deal to acquire Novia Financial. This is the third investment by AnaCap in the wealth management platform space following recent acquisitions of Amber Financial Investments and Wealthtime.

Polar Capital, the specialist active asset management group, announced that it had reached an agreement to acquire Dalton Strategic Partnership, a boutique asset manager with over £1.2bn of assets under management, for £15.6m. Elsewhere in the asset management space, Aberdeen Standard Investments agreed to acquire 60% of Tritax Management, a property fund manager with £5.1bn of assets under management throughout the UK and Europe. Japanese financial services group ORIX Corporation bought a 70% stake in Gravis Capital Management, a specialist fund management firm.

The IFA sector saw further consolidation with Fairstone acquiring Bath and Bristol-based Sovereign Wealth Management and South Wales-based UskVale Financial Planning, with c. £120m of client assets. Fairstone also agreed to a downstream buyout of South Devon-based Sabre Financial and consolidator Independent Wealth Planners announced the acquisition of Donald Wealth Management, adding £135m of assets under management.

In the wealth management space, Schroders completed the previously announced acquisition of London-based family office, Sandair, and Brooks Macdonald finalised the purchase of Lloyds Bank International’s Channel Islands wealth management and funds business after receiving all the necessary regulatory permissions.

In the pension and investment consulting arena, Charterhouse Capital Partners agreed to acquire Inflexion’s minority stake in Lane Clark & Peacock along with the firm’s group of partners.

Lending

Whilst activity continued to be modest as the year concluded, there were nevertheless a number of M&A transactions in the banking sector. Arbuthnot Banking Group announced that its subsidiary Arbuthnot Latham had agreed the purchase of the entire issued share capital of Asset Alliance Group Holdings Limited from CS Capital Partners III (“Cabot Square”) for a consideration expected to be c. £4.1m. Shawbrook Bank announced it had completed the acquisition of RateSetter’s peer-to-peer funded development finance business, including the purchase of a development finance loan portfolio with facilities totalling £167m.

In addition, Metro Bank confirmed the sale of a portfolio of owner occupied residential mortgages to NatWest Group for a cash consideration of up to £3,128m, representing a 2.7% premium on gross book value. However, The Co-operative Bank announced that it had ended discussions after having attracted an approach from a financial sponsor with knowledge and experience of investing in European financial services businesses.

“We have great IT and systems”. This is something we hear a lot. Either when talking to clients about selling their businesses, or when acting in a buyside advisory role and helping a client appraise a possible target, everyone is keen to tell us about the fantastic technology that really differentiates their business.

Many financial services businesses have of course been completely transformed by changes in technology. What is more, it is frequently an area where nimbler, smaller businesses have an advantage over their larger, more established competitors. But they can’t all be right. Not everyone can have better technology than their competitors. By definition, half of all businesses out there must have worse-than-average technology.

So why do so many businesses think that their tech and systems are better than the next person’s? Well, in many cases it is because they don’t really know what the next person has or does. They know that their own technology has made them far more efficient than they were even a few years ago, but perhaps miss the fact that this is probably also true of most of the competition. They tend to overestimate their superiority, not fully realising that the baseline has moved – and keeps moving. Good and constantly improving systems are sometimes about just keeping up.

A common fallacy we often find when selling a business is around the seller’s perception of the attractiveness of their technology and the value that a buyer will ascribe to it. It may be valuable to them, but will a buyer see it that way? Typically, a larger acquirer will be looking to make cost savings after a deal by pushing its own tech and systems down into an acquiree. For this reason, they may be quite ambivalent about the target’s technology – it represents something they intend to get rid of.

There is a wider point here. Sellers often struggle to put themselves into the shoes of a buyer, to get outside their own business and look at it the way a buyer will. But doing so is critical to finding the right buyer and achieving the maximum value for a business. O wad some Pow’r the giftie gie us, To see oursels as ithers see us! An experienced adviser will help you understand how a buyer will think about your business. If you think your own business might benefit from an outside-in view, we’d love to hear from you.

Insurance

November marked the biggest and busiest month for UK Insurance M&A for some time, with over £10bn of announced transactions, including three high profile public takeovers and several major transactions involving both carriers and distribution businesses.

The most headline grabbing deal of the month was of course the recommended cash offer for perennial takeover target RSA Insurance Group, by a consortium led by Canada’s Intact Financial Corporation and including Scandinavian insurer Tryg A/S in a deal that will see the historic British insurer being split up.

The two other public deals in the month were the much-trailed takeover of The AA, the motoring association that is also one of the country’s largest personal lines insurer, by private equity firms Warburg Pincus and Towerbrook, and GoCo Group, owner of price comparison website GoCompare, by Future plc, the acquisitive FTSE 250 publishing group.

In a similarly high-profile broking transaction, the race to acquire leading wholesale broker Miller Insurance Services, part of Willis, was won by private equity firm Cinven and Singapore’s GIC. Cinven were again in the news later in the month with the announcement that alongside British Columbia Investment Management Corporation (BCI), they had agreed to acquire legacy acquirer Compre from existing owners CBPE Capital and Hudson Structured Management.

As ever, there were a number of smaller broking deals announced in the month. By far the most active of the consolidators was Aston Lark, who announced the acquisitions of two brokers from Risk Alliance Group (part of Accelerant), namely Risk Alliance Limited and Risk Alliance International Limited. A few days later Aston Lark announced that it had agreed to acquire MS Amlin’s personal leisure craft business, which it will relaunch next year under its historic Haven Knox-Johnston brand. Finally, the group announced that it was forming a joint venture with Jeremy Miles and Russell Kilpatrick to create Spring Partners, a new MGA platform that will get underway through its first acquisition, Neon Sapphire Underwriting.

In other broking deals, Howden Broking continued its recent spate of deals with the acquisition of cyber-focused Lloyd’s broker Safeonline Insurance Brokers, GRP-owned Marshall Woolridge acquired Rotherham-based RIB Group, Daulby Read Insurance Brokers acquired Townsends Insurance Brokers in Prestatyn, Brunel Insurance Brokers acquired Inman & Associates in Coventry, and Worcestershire-based Hazelton Mountford acquired Michael Rollett & Co. In a deal that had been expected for a while, PIB Group announced it had acquired rental property specialist and Carlyle stablemate Barbon Insurance. Finally, independent broker JM Glendinning Insurance Brokers announced that it had undergone a Management Buyout, led by CEO Nick Houghton and backed by Synova Capital, in a deal that sees the return to the market of Tim Johnson and Jeremy Cary of Stackhouse Poland fame, as Executive Chairman and Board Adviser, respectively.

Among carriers, there was continuing capital raising activity. Convex Group, the specialty insurance and reinsurance business founded by Stephen Catlin announced that it had raised a further $1bn of equity capital in a funding round led by existing investors Onex Corporation and GIC. Separately, new specialty insurer Inigo, led by Hiscox alumni Richard Watson, Stuart Bridges and Russell Merrett, announced that it had raised $800m from a group of investors including JC Flowers, CDPQ, Oak Hill Advisors and Qatar Investment Authority. Inigo will launch at Lloyd’s through managing agency Starstone Underwriting and Syndicate 1301, having acquired Starstone from Enstar, Stone Point and venture capital firm Dowling, who will remain investors in Inigo.

Investment

The investment platforms market is currently attracting interest. It was reported that Standard Life Aberdeen was exploring the sale of Parmenion to simplify its offering to financial advisers and that Sanlam had begun a process for a potential sale of its 52.2% stake in Nucleus. Just after the end of the month, Nucleus did indeed confirm in a stock exchange announcement that Transact’s parent company, Integrafin Holdings, and private equity firm Epiris, the investor in James Hay, were in talks over proposed cash offers for the platform business. Nucleus has also received proposals from private equity house Aquiline Capital Partners and fund distribution platform Allfunds.

Elsewhere, Stanhope Capital Group and FWM Holdings, which owns Forbes Family Trust, LGL Partners and Optima Fund Management, announced that they had merged to create a wealth management and advisory business, overseeing $24.2bn in client assets with 135 employees operating in six offices worldwide. WH Ireland agreed to acquire financial advisory and wealth management firm Harpsden Wealth Management for £7.8m and Multi-asset manager Alpha Beta Partners acquired discretionary fund manager MitonOptimal UK. Tatton Asset Management secured a £30m loan to fund its acquisitions plans in the DFM space.

In the financial advisory sector, Apiary Capital backed the buy-out of Radiant Financial Group, formerly known as CWB Group, an IFA, employee benefits and business consultancy services group. Fairstone, the national advice group, acquired Hampshire-based Cube Financial Planning through its downstream buy-out programme, adding £150m of asset under management and 153 clients. Sussex-based Pembroke Financial Services bought GMIFC and Independent Wealth Planners expanded in the Midlands with the takeover of Bishop Armstrong Financial Planning, its ninth acquisition this year.

In the investment technology arena, Souter Investments and Manfield Partners backed an MBO of LIKEZERO, a leading provider of next generation intelligent data capture technology for the financial services industry, from PwC, and Bravura Solutions acquired Delta Financial Systems, the software company that provides technology for pensions administration, including the SIPPs and SSASs markets.

Lending

There were a number of announcements in the UK banking market. J Sainsbury announced that it had received very preliminary expressions of interest in Sainsbury’s Bank while The Co-operative Bank announced that it had attracted an approach from a financial sponsor with knowledge and experience of investing in European financial services businesses. Separately, there was speculation surrounding interest in Starling Bank which announced it had reached profitability and was said to be embarking on a £200m fundraising.

Following an initial announcement regarding a possible offer in February 2020, Waterfall EIT UK (a newly formed company owned by funds managed by Waterfall Asset Management) announced a recommended cash offer for Alternative Credit Investments (formerly Pollen Street Secured Lending), valuing the entire issued and to be issued ordinary share capital at c. £639.2m.

Elsewhere, Mobeus Equity Partners announced that it had sold its interest in Advantedge Commercial Finance to eCapital Corp., a US SME commercial finance provider.

As the UK’s budget deficit continues to balloon and commentators pontificate on how the economic fallout from the current pandemic will ultimately be paid for, I expect that many of you have begun to hear rumblings that a change may be coming for the Capital Gains Tax regime, possibly as soon as March 2021. You may equally have wondered whether you might be able to sell your business before a new higher tax rate becomes effective.

It is indeed quite possible that the CGT rate will be changed next year. And it won’t be going down. But no one can say yet with any certainty what might happen. What is more certain is that, if you decide to initiate a sale process for your business today, then it is highly unlikely that you will complete it before the Spring. Of course, not every adviser will tell you that today; they might prefer to sign you up with the promise that they can effect a quick transaction, only informing you in a few months’ time that – so sorry – the timetable has slipped.

Sales processes and M&A involving regulated financial services businesses are complicated. Deals that go from start to finish in less than six months are the exception rather than the rule. An experienced adviser that really understands your business will know this. A good adviser should also have the courage to inform you about what is realistic, not just what is likely to win them the sale mandate.

If you would like to discuss your own M&A plans, do get in touch.

Insurance

October was another active month for UK Insurance M&A with 14 new transactions being announced among brokers, insurers and MGAs. Six of these deals involved a private equity-backed broking consolidator, again highlighting what a large proportion of current sector M&A activity is being driven by a relatively small number of buyers of (mainly) commercial lines broking business.

Dealing first with those consolidators, GRP’s new Midlands ‘hub’ business Birrell Group (which trades as Kingsway Insurance Services) announced two acquisitions, acquiring both Northamptonshire-based Managed Risk Solutions (MRSL) and Home Counties Insurance Services (HCIS) in Bedfordshire. In addition, GRP’s Yorkshire hub business Marshall Woolridge acquired Messrs R F Broadley, a long-established family owned broker in Masham. Fellow consolidator PIB Group announced two new deals in the month, acquiring real estate and PI specialist Arlington Insurance Services and Leicester-based Erskine Murray Insurance Brokers, the latter of which employs 90 staff and marks the group’s largest acquisition this year. Finally, Aston Lark announced it had acquired Birmingham-based broker Dunsby Associates in a deal that will help to build out the group’s presence in the Midlands.

Elsewhere in broking, A-Plan announced that it had acquired telematics business Ingenie from Watchstone Group and essential business services group Verastar acquired building insurance specialist LittleNLarge in a deal that will expand Verastar’s range of services for SMEs.

There were three deals announced among MGAs, including transactions for books of business. Pioneer Underwriting disclosed that it had signed terms to sell the business to Russell Coward, its head of Risk & Compliance, in a move that will see Pioneer CEO Andrew McMellin step down and the business rebranded. Manchester Underwriting announced that it had acquired the renewal rights of PI specialist Pinpoint Underwriting and would add Pinpoint’s team and Perth office to the group. Finally, Ardonagh-owned Geo Underwriting announced that it had completed the acquisition of the marine, leisure and marine trade book of business from KGM Underwriting Services.

Among insurers, Tesco Bank confirmed it had reached agreement with joint venture partner Ageas UK to buy Ageas’s 50.1% stake in Tesco Underwriting to give it full control over the business in a deal that was first flagged almost 12 months ago. Aegon announced it will divest the UK arm of its accident insurance business Stonebridge Insurance to Global Premium Holdings, part of the Embignell group of companies that also includes Union Income and Union Insurance. Lastly, the steady flow of legacy deals that has been a prominent feature of sector M&A this year continued with the announcement that ArgoGlobal had reached an agreement around an RITC transaction with legacy specialist RiverStone in respect of Lloyd’s Syndicate 1200.

Investment

Fidelity International bolstered its direct to consumer proposition by announcing two acquisitions: Legal & General Investment Management’s UK personal investing business and the low-cost platform Cavendish Online. The deals will bring more than 330,000 customers and £5.9bn of assets to the Fidelity platform.

In the asset management space, Momentum Global Investment Management (MGIM) agreed to acquire Seneca Investment Managers, creating a combined business with assets under management of £4.7bn and offices in London and Liverpool. Liontrust completed the previously announced £75m acquisition of the Architas UK Investment Business from AXA.

In the wealth management area, LGT Group, which is controlled by the Liechtenstein royal family, took full control of wealth manager LGT Vestra after having acquired the remaining equity from the firm’s executive partners. Prydis bought Edinburgh-based Virtuo Wealth Management, a financial advisory business that focuses on ethical and sustainable investments. Walker Crips purchased the client book and assets of Yorkshire high net worth financial adviser MA Heap.

In the IFA sector, Chase de Vere acquired Nestor Financial Group, a specialist IFA practice working with personal injury and clinical solicitors and their clients. Fairstone, the national advice group, completed the acquisition of Andrew Cohen Associates through its downstream buy-out programme, adding £150m of asset under management and 850 clients. Lucas Fettes Financial Planning acquired the business of Andrew Dickson and Colchester-based Fiducia Wealth Management was subject to a management buyout.

Elsewhere, The Carlyle Group has agreed to acquire a majority stake in the global funds network Calastone from its current shareholders, including Octopus Ventures and Accel.

Lending

Equity capital raising transactions were flavour of the month as M&A activity continued to be relatively subdued in the lending markets.

City of London Group announced the completion of a c. £26.7m equity capital raise while its subsidiary Recognise Financial Services progressed its application for a banking licence. Augmentum Fintech announced the successful completion of its equity capital raise of c. £28.0m, through a placing and retail offer, to fund its pipeline of investment opportunities. Molo, the digital mortgage lender, announced that it had raised a further £266m in debt and equity funding, completing its series A equity funding round. The investment was led by Macquarie Group and Patron Capital, with the equity round led by Yabeo and supported by existing shareholders including Andenes Investments and GPS Ventures.

Elsewhere, Pollen Street Secured Lending announced that the Panel on Takeovers & Mergers had once again consented to an extension of the relevant deadline until 3 November 2020 for funds advised by Waterfall Asset Management to conclude on a possible cash offer for the company.

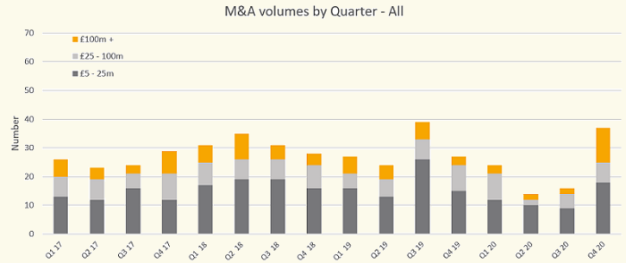

With data for two full quarters since Covid-19 upended so many plans in March, we thought it would be a good time to look at our M&A statistics, to understand how far Financial Services deal volumes might be recovering as lockdown has been (partially and perhaps only temporarily…) relaxed.

The short answer is that deal volumes in the third quarter of this year were marginally higher than the previous quarter, but still substantially lower than in the corresponding period in 2019. There were 16 UK Financial Services M&A transactions estimated to be valued at more than £5m during the quarter, up from the 14 in Q2 – a period in which the UK was in full lockdown and, so one might hope, the nadir for deal activity. That is less than half the number of deals (39) we saw in Q3 2019, albeit that quarter marked a multi-year high, well above the quarterly average number of deals of 27 since 2017.

In terms of where deals are happening, the Insurance sector has continued to dominate M&A, followed by Investment. This is perhaps not surprising. Notwithstanding the damage that has been done to many insurers’ reputations as a result of the pandemic, the sector has proven very earnings resilient and the drivers supporting much of the recent deal activity, not least the appetite of private equity investors, remains intact. Similarly, the wealth management sector has shown strong performance throughout the pandemic despite adverse stock market developments and a slowdown in new business activity.

However, M&A activity in the Lending sector has been muted, with fewer than a dozen transactions in the year to date. Again this is no surprise – it is arguably within this subsector that the level of uncertainty created by the pandemic has been greatest, making M&A more difficult.

Deals are still being done and generally on terms not dissimilar to those seen before the pandemic. The quarter saw a number of high-profile transactions being announced, in both the public and private markets. We have seen very few distressed deals. It will take time for animal spirits to fully return, but buyer appetite remains robust and deal volumes are likely to continue to edge up.

If you’d like to discuss how current M&A trends might be relevant to your own business then we’d love to hear from you. We are always happy to meet up, either in person or via ‘Zoom’ etc.

Insurance

September looked like being a relatively quiet month for Insurance M&A until the last week of the month, when a number of notable new transactions were announced.

Grabbing most of the headlines was Hyperion Insurance Group and its subsidiary Howden, with the announcement that it had acquired Hg Capital-backed A-Plan Group in a transformational deal for Howden’s retail arm, creating a £4bn GWP broker. A few days later Howden announced that it had also acquired specialist PI broker St Giles Legal & Professional Risks, cementing its leading position in that market segment. Finally, Hyperion revealed that it had sold a stake to Hg in a c.$1bn deal valuing the group at nearly $5bn and providing further funding to support its growth.

Elsewhere in commercial broking, ECI Partners-backed Clear Group announced that it had acquired Brokerbility Holdings, the Leicester-headquartered group comprising inter alia BHIB Insurance Brokers, Churchill Insurance Consultants and the Brokerbility Network, of which Clear is a longstanding member, Aston Lark acquired its second Lloyd’s broker in as many months by purchasing specialist PI broker Brunel Professions, US Broker NFP acquired Birmingham-based Ernest R Shaw, and AssuredPartners’ UK arm announced the acquisition of Chester-based medical malpractice specialist Red Insure, along with commonly-owned underwriting agent Everest Risk Management.

In personal lines, Ardonagh announced it had acquired specialist motor broker Lloyd Latchford, troubled over 50s travel and insurance specialist Saga launched a £150m capital raise led by former owner Sir Roger De Haan, and listed roadside assistance provider the AA (which also happens to be one of the UK’s largest personal lines brokers) announced that it was in continuing discussions with private equity firms Warburg Pincus and Towerbrook Capital Partners about a potential takeover of the group.

Among insurers, Beat Capital announced it would partner with private equity firm Bain Capital to support Beat Capital’s underwriting businesses through Lloyd’s Syndicate 4242 and American Financial Group (AFG) announced that it had completed its previously flagged exit from the Lloyd’s market with the sale of its insurer Neon to run-off specialist RiverStone.

Finally, in Insurtech, acquisitive professional services and technology firm the Davies Group announced that it had acquired ContactPartners, a business specialising in building customer contact solutions for financial services businesses.

Investment

It was reported that Royal London is pursuing a potential £500m takeover of LV= in a deal that would create a pensions, life insurance and asset management group with £139bn of assets under management and over 10m customers. It was also suggested that Bain Capital, the private equity investment firm and backer of motor insurer esure, is also keen on acquiring LV=. Subsequently, LV= confirmed that it is indeed in exclusive discussions with Bain Capital about a potential transaction, dismissing reports that talks with Royal London were still happening.

In the wealth management area, Schroders announced that it had reached an agreement to acquire Sandaire, the London-based family office with c. £2.2bn of client assets, and 7IM, which is backed by Caledonia Private Capital, completed the acquisition of London-based advice firm Partners Wealth Management in a deal that will boost 7IM’s client assets by over £2bn. Gale and Phillipson completed the acquisition of Gyr Financial Consulting, adding about £200m of funds under management.

There were continued high levels of activity in the IFA sector with The Socium Group, a private equity backed national group which launched last year, buying Beaufort Group, a financial services firm operating both an adviser network and a discretionary fund management arm with c. £1.1bn of assets under management. Adviser Services Holdings, a newly established IFA network, announced it had agreed to buy the Sense Network for £9.35m as part of its plans to build a 500-strong adviser network following its acquisition of Lyncombe Consultants, an IFA network with 30 advisers, earlier this year. Independent Wealth Planners acquired Hove-based Hunter Hammond Daniel Associates, adding around £200m in assets under advice, Solihull-based Beyond Financial with £58m of assets under advice and Kilmarnock-based Gilmour Hamilton Wealth Management. Kingswood Holdings agreed to acquire Surrey-based Regency Investment Services for £3.45m, adding £320m assets under advice and around 1,000 clients. Perspective Financial Group acquired Wiltshire-based Jones Hill, bringing £44m of funds under advice to the group and Fairstone signed up Hereford-based Complete Financial Planning, which has over £140m of client assets, to its downstream buy-out programme.

It was also rumoured that Harwood Wealth Management is in advanced discussions to buy Gallagher’s UK planning business in a deal which could see around 25 advisers join Harwood Wealth Management.

Elsewhere, asset manager Victory Capital Holdings acquired a 15% stake in London-based investment firm Alderwood Partners, the operating entity of Alderwood Partners, an investment advisory firm focused on taking minority stakes in specialist boutique asset management businesses.

Lending

The UK SME banking market saw a number of transactions: Allica Bank announced a follow-on investment of £26m by existing majority shareholder, Warwick Capital Partners, while launching a £100m funding round to accelerate its lending; and City of London Group announced a conditional capital raise of up to £30m while its subsidiary Recognise Financial Services progresses its application for a banking licence. The capital raise comprises a £25m subscription by Parasol V27 and a £5m placing to existing shareholders and potential new investors.

Pollen Street Secured Lending (PSSL) announced that the Panel on Takeovers & Mergers had once again consented to an extension of the relevant deadline until 6 October 2020 for funds advised by Waterfall Asset Management to conclude on a possible cash offer for the company. However, Honeycomb Investment Trust, which had previously announced that it had made a competing proposal to PSSL, announced that it did not intend to make an offer.

Elsewhere, fintech lender Capify closed a £8m equity funding round; Metro Bank announced the completion of its acquisition of Retail Money Market (trading as RateSetter); and Arrow Global Group announced that it had held a third close of its inaugural closed-end fund Arrow Credit Opportunities, raising an additional €0.3bn of capital commitments, bringing total capital commitments to €1.5bn.

“Due diligence won’t be hard, we are a simple business with great information”. How often do we hear this from sellers? More often than I would care to remember. How often does it turn out to be correct? Almost never.

At the start of any sale process, we warn our clients that due diligence will be a demanding process; a slog and a strain and often deeply frustrating. They nod and smile politely, but they don’t really believe us. Only at the end of a process do they realise how far they had underestimated the scale of the challenge and the time it will take, as we resist the temptation to say “I told you so”.

It is understandable why many sellers can be blasé at the outset of a diligence process. They have great businesses, good systems and detailed information. But that information is usually what is right for them, as owners and managers of the business. It is not everything that a buyer – and its financiers – need to see in order to sign off a deal to buy the company.

Modern, institutional-level due diligence in Financial Services is unbelievably demanding. Many private sellers who have not been through it before fail to anticipate just how much information a buyer will want to see and the sorts of questions they will ask.

Some due diligence is about fully understanding the target business and its fit with the acquirer, but most due diligence is a risk management exercise. It is a drains-up investigation of nearly every aspect of a business and its past. It is far more thorough than any financial audit.

It is also something that many buyers will heavily outsource – not just to lawyers and accountants, but increasingly to dedicated specialists covering areas such as IT, Compliance and HR. These third-party providers produce reports for the buyer that they are asked to stand behind and, therefore, have an interest in being rigorous.

So what can a seller do to make life easier? Commissioning a Vendor Due Diligence exercise is one option, but this can be expensive and will not suit every business. Preparation and adequate resourcing is another, of course, but in our experience it is almost impossible to fully ready a business for the process in advance. The best advice is often just to accept it. Don’t take it personally. Think of it as something difficult but necessary, that hopefully only has to be done once.

It also helps to have an experienced adviser on your side, to guide you through and coordinate the process, taking on the heavy lifting to allow management to remain focused on actually running the business. If you’d like to discuss your own plans, do get in touch.

Insurance

In last month’s newsletter we commented that August can often be a quiet month for M&A, as people disappear for the summer. Well, that was clearly utter rubbish, as this August has seen a slew of announced Insurance deals, mainly on the distribution side but also involving risk carriers.

In broking, there were ten announced deals in the month and with only one exception, the buyers were all what one might regard as the “usual suspects”, which is to say the private equity-backed consolidators that have come to dominate these newsletters.

Aston Lark announced two new deals during the month, acquiring both specialist employee benefits business Private Healthcare Managers, or PHM, and Lloyd’s broker Incepta Risk Management, furthering the group’s existing footprint within the London Market.

Also announcing two new deals was Ethos Broking, which announced the acquisition of Broker Network member Guy Penn & Co. in the North West and, via hub broker Bennett Christmas, Sennet Insurance Services, a commercial broker in Kent.

Global Risk Partners managed to go one better, with three new deals. Two of these were via hub business County Group, which announced the acquisitions of Britannia Consultants Services in Cheshire and CJN Insurance services in Worcestershire, and the third directly by acquiring the renewal rights on seven books of business from Aon UK.

Not to be outdone, PIB Group announced the acquisition of transport specialist Rigton Insurance Services in Leeds and the increasingly prolific Bollington Wilson acquired Watson Laurie, a chartered broker based in the North West.

The one broking deal not involving a PE-based consolidator was Costero Brokers’ acquisition of fellow Lloyd’s broker Prospect Insurance Brokers. Costero is part of the Heffernan Insurance Brokers, a Californian employee owned business, demonstrating that UK broking M&A is not quite yet the sole preserve of the handful of serial acquirers discussed above.

There was one MGA transaction, with Ardonagh announcing the acquisition of construction specialist Thames Underwriting.

Among insurers, we noted last month that Finnish group Sampo was leading a pursuit of listed motor insurer Hastings Group. In early August Hastings, announced that its board had recommended a cash offer for the business that valued the group at £1.66bn. There were also two deals for insurers in run-off during the month. Randall & Quilter announced that it had agreed a deal to acquire Inceptum Insurance Company from the Vibe Group of companies and Allianz announced that it had divested the British Reserve Insurance Company to newly formed Marco Capital Holdings, a Malta-headquartered run-off specialist backed by, among others, Oaktree.

Investment

Inter-dealer broker TP ICAP announced the acquisition of Louis Capital Markets and MidCap Partners (collectively known as “Louis Capital”), a private brokerage group specialising in equities and fixed income, primarily based in Europe, for an initial consideration of $21m in cash and a deferred non-contingent consideration of $6m, as well as a further $17m deferred contingent consideration.

In the pension administration area, STM Group acquired Berkeley Burke (Financial Services) and Berkeley Burke Employee Benefit Consultants from Berkeley Burke Group, which together provide administration and consultancy services to Small Self-administered Pension schemes in the UK and to large and medium sized UK and international businesses, for a maximum consideration of £2.9m, comprising of £1.4m initial consideration and a further £1.5m of contingent deferred consideration.

In wealth management, Fairstone finalised the acquisition of Berkshire-based Chiltern House after they completed a two-year integration, adding 500 clients, £2.6m in gross fee income and £400m AUM to Fairstone. Seven Bridges acquired Gateshead-based pensions and investment firm Pension Matters, bringing 600 new clients to the group and adding £110m of AUM. Wren Sterling completed the acquisition of Woking-based Frobisher Capital, which has some £68m of AUA. AFH Financial acquired the client book from the insolvent Welsh business Juno Moneta Capital, after the latter went into administration.

In asset management, M&G Investment Management raised their cash offer by 4.5% to £191m for UK Mortgages, the debt-focused investment trust, but it was dismissed by UK Mortgages which said it can do more for shareholders in a strategic review of the business.

Timelineapp, the next-generation retirement income software, secured £1.8m in funding from FNZ, becoming a non-controlling minority investor, along with Capital Asset Management’s CEO Alan Smith, Open Money’s CEO Anthony Morrow and Andrew Hart, as well as existing investors Jason Butler, Adam Seale and Tim Wright.

Payments & Lending

In payments, cloud-native payments technology platform Form3 raised $33m in a strategic investment round with new investors Lloyds Banking Group, Nationwide Building Society and venture capital firm 83North following its announcement of a strategic partnership with Lloyds Banking Group in July 2020. CloudPay, the UK-based global payroll provider, raised $35m in growth capital with new investor Runway Growth Capital joining existing investors Rho Ventures and Pinnacle Investment Partners, real-time cross-border payments firm Vitesse raised £6.6m in Series A funding led by Octopus Ventures, with participation from existing shareholders including Hoxton Ventures and other angel investors and open banking-focussed fintech sync. reported a £5.5m seed and pre-seed round, which was actually completed earlier on in 2020, and will be used to grow the fintech’s employee numbers as well as bolster its beta launch across the European Economic Area.

Wirecard Card Solutions (WCS) Ltd, a wholly owned subsidiary of Wirecard Acquiring & Issuing GmbH and part of the insolvent Wirecard AG group, agreed a term sheet to sell its card technology and associated assets in the UK and to effect the transfer of client relationships and certain employees to the Banking-as-a-Service platform Railsbank, as part of WCS’s plans for reaching a solvent wind-down of the business. Wirecard AG will continue to hold ownership of Wirecard Card Solution’s shares.

Elsewhere Solidatus, the provider of innovative metadata management software, received a strategic investment from Citi, which is also implementing the Solidatus platform internally, at a global enterprise level and Cornerstone Brands announced the acquisition of payments processor FXPress whilst also selling its existing Cornerstone business and restructuring capital. The new corporate business will offer international payment services for small- to medium-sized businesses.

Pollen Street Secured Lending (PSSL) announced that the Panel on Takeovers & Mergers had once again consented to an extension of the relevant deadline until 8 September 2020 for funds advised by Waterfall Asset Management to conclude on a possible cash offer for the company. However, Honeycomb Investment Trust subsequently announced that it had made a competing proposal to PSSL regarding a possible merger on a NAV for NAV basis which would result in PSSL shareholders holding c. 65.3% of the enlarged group. The Board of PSSL announced that it did not believe the possible Honeycomb offer compared favourably in value or liquidity terms.

Following last month’s announcement by the boards of HWSI Realisation Fund and Cubitt Trade Holdings of a recommended cash offer valuing HWSI at c. £79.6m, the requisite shareholder resolutions were duly passed with the transaction expected to complete in September. Tandem Bank acquired green lending business Allium Lending Group as part of a £60m fundraising deal announced in March 2020, led by the Qatar Investment Authority, although at that stage the name of the planned acquisition was not given.

Elsewhere, Habito confirmed that it had closed a £35m investment as part of its Series C fundraise. The overall investment round, which included a Series C extension in the form of a convertible loan note, was led by Augmentum Fintech, SBI Group and Mojo Capital with support from existing investors Ribbit Capital, Atomico and Mosaic Ventures.

The summer months invariably see a bit of a slowdown in announced M&A activity, although it is actually not unusual to see a mini spike in transactions in July, as buyers, sellers and their advisers rush to finalise deals before the August exodus. Such a mini spike was not really observable last month, but of course this is not a “normal” year and many planned transactions will be suffering from delays and elongating timetables.

Intuitively, one might think that the summer is not a good time to do a deal, given the need to manage people’s holidays and the obvious logistical difficulties involved in getting the various decision makers and their advisers together at the same time. We would observe that while it is not a great time to launch a new process and market a business for sale, for deals that have already got a head of steam by around June, the quieter summer months can actually be a good time to get through due diligence and finalise a deal (indeed IMAS is currently advising on a number of transactions that are expected to conclude this month). Equally for new deals being readied, the summer months can provide a useful period for planning and preparation.

In this most unusual of years, the summer is giving many business owners a chance to reflect on their plans and prospects. The longer-term impact and implications of Covid-19, while still uncertain, are becoming clearer than they were just a few months ago. Business risks are being re-evaluated. as companies and their owners reassess their priorities. We would expect new decisions around M&A to be made and plans hatched among both buyers and sellers.

We hope you are managing to get a break this summer and enjoying the weather. Should your thoughts turn to M&A and you wish to discuss ideas for your own business, we’d love to hear from you.

Insurance

There were a number of notable deals in the Insurance sector, with both distribution-led businesses and selected risk carriers involved in M&A.

Among the private equity backed broking consolidators, PIB Group announced the acquisition of Stockton-based Internet Insurance Services UK, trading under the slightly snappier name of UKInsuranceNet, Livingbridge-backed Jensten Group announced its second deal of the summer with the acquisition of PI specialist HTC Associates, and Aston Lark continued its drive to build out the employee benefits side of its business with a deal to acquire Hampshire-based specialist Private Healthcare Managers (PHM).

In other broking deals, S&G Risk Solutions (a new vehicle led by former Property Insurance Initiatives CEO Brett Sainty) announced the acquisition of Lloyd’s broker BLW Insurance Brokers and personal lines broker Brolly was picked up by Direct Line Group. App-based digital broker Brolly is a relatively young startup business and is one of an increasing number of early-stage insurtech businesses to be acquired by large incumbents choosing to selectively buy the sort of innovation that they can often struggle to foster internally.

Finally, listed motor insurer Hastings Group announced that it was in discussions about a possible cash offer from Sampo, the Finnish insurance group, working alongside Rand Merchant Investment Holdings (RMI), an existing major shareholder in the business. With the FTSE 350 (and Sterling) still down heavily for the year, it is perhaps not a surprise to see that overseas buyers and institutional investors are looking at public to private opportunities in the UK market.

Investment

Curtis Banks, the pension administration provider, announced two acquisitions: First, of the SIPP and SSAS provider Talbot and Muir for up to £25.3m; and second, the fintech firm providing software for retirement modelling and policy administration, Dunstan Thomas, for £27.5m.

There was consolidation in the investment trust sector with Perpetual Income & Growth, the £466m UK equity income trust, agreeing to merge with its £509m peer Aberdeen Standard’s Murray Income Trust. M&G Investment Management revealed last week it had made several approaches to the board of UK Mortgages, a debt-focused investment trust, with a view to take over the company, all of which have been rejected.

Shares in Hadrian’s Wall rocketed nearly 90% after the listed debt fund, which is winding down after suffering loan losses, accepted a cash offer from a US-based Petra Group’s subsidiary, Cubit Trade Holdings, for the entire portfolio for £79.6m.

In the adviser investment platform market, Fundment secured a £3.4m funding from investment company ETFS Capital to help expand its UK operations and there was speculation in the press that private equity firm AnaCap Financial Partners is eyeing up another platform acquisition as discussions circle around Tatton Asset Management-linked Amber.

Elsewhere in the wealth management area, Frenkel Topping raised £13m for acquisitions after having announced the acquisition of accountancy firm Forth Associates, with offices in Manchester and Leeds. Synova-backed Fairstone announced it had bought a stake in Surrey-based Mantle Financial Planning as part of its Downstream Buy-Out programme, adding gross fee income of £3.3m and over £480m AUM. Oxfordshire-based CMS Financial Management acquired Buckinghamshire-based advice firm Asset Wise Associates which has c. £120m of client assets and Sussex-based IEP Financial completed the acquisition of RT Williams’s investment, pension and life insurance businesses with £50m in client assets.

On the capital raising front, money management app Plum raised $10m led by Japan’s Global Brain and the EBRD with participation from VentureFriends as well as match funding of $2.5m from the UK government’s Future Fund scheme. Moneybox, the investment app provider, raised £30m in a Series C venture funding from Eight Roads and CNP and joined by Breega achieved double its Series B valuation in 2018 – Moneybox also tapped crowdfunding platform Crowdcube to raise £4m in just four hours.

Payments & Lending

The payments technology sector attracted headlines in July as international payments firm TransferWise completed a $319m secondary share sale, valuing the business at c. $5bn, led by existing investor Pine Capital and new investor D1 Capital Partners with current investors Baillie Gifford, Fidelity Investments and LocalGlobe expanding their holdings in the firm, while Vulcan Capital also participated. Revolut, the banking services platform, secured a £63m investment from US-based private equity firm TSG Consumer Partners at the $5.5bn valuation announced in February’s funding round. Lloyds Bank acquired a minority equity stake in Form3, the payments-as-a-service provider for banks and regulated FinTech companies, to help overhaul its legacy payments architecture to the cloud.

In lending technology, UK-based digital lender Selina Finance raised £42m in Series A funding with £12m in equity financing from Picus Capital and Global Founders Capital and £30m in debt financing. Core banking technology firm Thought Machine secured an additional $42m from Eurazeo, SEB and British Patient Capital to reach a total of $125m in Series B funding. Wagestream, the flexible wage app business, closed a £20m Series B funding round led by Northzone and joined by QED Investors, Latitude Ventures and Balderton Capital taking its total funding to £65m. Milaya Capital invested £15m in Lanistar the personal financial management start-up leveraging polymorphic technology in exchange for a 10% stake and alternative investment manager Intriva Capital acquired Lending Works the P2P lending platform where they will commit significant additional capital to support the growth of the business.

Elsewhere, big data and enterprise intelligence business Quantexa, raised $64.7m in a Series C funding round led by Evolution Equity Partners, the cyber security venture capital investors, with return backers Dawn Capital, AlbionVC, HSBC and Accenture also participating alongside new investors British Patient Capital and ABN AMRO Ventures. ComplyAdvantage raised $50m led by Ontario Teachers’ Pension Plan Board and joined by existing investors Index Ventures and Balderton Capital, Ravelin the payment security business raised £16.4m in a Series C round led by Draper Esprit to expand its operations overseas and industry coverage and Standard Chartered acquired a minority stake in blockchain-based post-trade processing network Cobalt.

As the broader lending M&A markets continued to be subdued, the peer-to-peer market saw a number of transactions. In the consumer credit segment, Metro Bank announced that it had conditionally agreed to acquire Retail Money Market trading as RateSetter for an initial consideration of £2.5m with additional contingent consideration of up to £9.5m payable within 3 years; and Lending Works announced that Intriva Capital will conditionally acquire 100% of the equity in the business with a further commitment to provide additional funding and capital to support future growth.

Following Hadrian’s Wall Secured Investments’ announcement earlier in the year that it had concluded its review of strategic options and had determined that the company should be put into managed wind-down, the boards of HWSI Realisation Fund and Cubitt Trade Holdings announced the terms of a recommended cash offer valuing the company at c. £79.6m. However, Pollen Street Secured Lending announced once again that the Panel on Takeovers & Mergers had again consented to an extension of the relevant deadline until 11 August 2020 for funds advised by Waterfall Asset Management to conclude on a possible cash offer for the company.

Elsewhere, Fair for You, the non-profit responsible credit provider, secured a £7.5m investment from some of the country’s biggest social investors and foundations. The £7.5m investment includes £5m in dormant assets funding from the Government-backed Fair4All Finance.

Half empty? Half full?

The impact of Covid-19 on UK Financial Services M&A is revealed with the publication of IMAS Q2 data.

Source: IMASinsight

The second quarter of this year saw the volume of M&A activity drop by 40% on the corresponding period in 2019, a level of decline not seen since IMAS started collecting detailed transaction information in 2011. Indeed, the Insurance sector has seen a drop of almost 70% (see below for individual sector analysis). The pessimist would say it would have been worse and that some of the deals done in 2020 might only have been conditional on FCA approval when the extent of Covid-19 became apparent and so could not have been pulled even if the buyer had wanted to. However, the fall in activity is symptomatic of a more consistent decline in volumes since the peak in Q3 last year.

Also, given the unprecedented restrictions in place, the volatility in global stock markets and the sheer level of uncertainty the economy still faces, the fact that any deals were done at all was a minor miracle.

That is certainly our experience here at IMAS where we advised on two transactions that were announced last week alone, as well as having taken on new business throughout the lockdown. Transactions are still happening, new sale processes are being initiated, and extensive home working is not proving as great an impediment to M&A as one might have expected before so many of us adopted it.

A key driver of M&A activity in recent years has been Private Equity firms. Their fund cycle and investment mandates with institutions last for years not months; that determines their decision making processes. They have raised billions in committed capital and they need to find places to make it work. So yes, they are closely reviewing each of their portfolio companies and often directing them to conserve cash, yes debt has become more expensive and difficult to secure, but capital is still available and needs to be deployed. Many vendors of companies are gaining a new understanding of the benefits of derisking, moderating their expectations on value and accepting greater risk sharing in transaction structures. Private equity firms with cash to invest will get no credit for burying their talents in the ground.

So do stay in touch with us. The appetite among the private equity funds and trade acquirers remain strong.

Insurance

After what was an eerily quiet May for deals, insurance M&A volumes notably picked up in June, with a number of broking and MGA deals being announced. Although the number of transactions remains some way below the long-term monthly average, deals are still being done and there are tentative signs of a return to some semblance of “normality”.

In commercial broking, Durham-based Castle Insurance Services announced it had acquired EW Knapton, Ethos-owned Bennett Christmas acquired energy broker Offshore & Marine Insurance Services (OMIS) and Thompson & Richardson (also an Ethos partner broker) acquired Scunthorpe-based Johnstone Insurance Brokers. As we have remarked before in this newsletter, the Ethos hub-and-spoke based approach has proved very effective in allowing the group to facilitate a large number of small acquisitions and we would anticipate continuing to report on one or other Ethos backed broker making a new acquisition in most of our monthly M&A newsletters for the foreseeable future.

Ethos was itself the subject of a headline-grabbing transaction during the month, with the (frankly unsurprising) news that Bravo Group – the owner of Broker Network, Ethos and Compass – was to be acquired by Ardonagh. Ardonagh simultaneously announced it had undertaken a refinancing of its debt and acquired Irish broker Arachas. As Ardonagh, Arachas and Bravo were already under common ownership by US private equity investors this transaction was largely constituted a reorganisation rather than “new” M&A activity.

In other deals, personal lines MGA UK General was reacquired by its former owner Primary Group following a three-year period of ownership by private equity investor JC Flowers & Co. JC Flowers will probably not count it as one of their more successful investments. Miles Smith owner Specialist Risk Group continued its recent run of deals by acquiring insolvency specialist AUA Insolvency Risk Services from insurer MS Amlin and Livingbridge-backed Jensten Group (née Coversure) acquired Lloyd’s broker Senior Wright.

Investment

In the asset management sector, Liontrust agreed a £75m deal to acquire the UK investment business of Architas, part of the AXA Group, including the multi-manager and advisory arms, adding £5.6bn worth of AUM and raising its total AUM to £25bn. Pacific Asset Management (PAM) acquired Parallel Investment Management, the discretionary fund management arm of the chartered financial planning firm, Fidelius Group, in exchange for PAM’s financial planning subsidiaries via a share swap, leading to a minority shareholding in each other’s businesses.

UK investment groups were also active offshore: Brooks Macdonald announced that it had entered into an agreement to acquire the Channel Islands wealth management and funds business of Lloyds Bank International for total consideration of up to £9.63m, including £2.5m of regulatory capital, with initial consideration being up to £9.30m; Schroders announced that it had reached an agreement to acquire a majority stake in Pamfleet, a value-add real estate investment manager with offices in Hong Kong, Shanghai and Singapore, with US$1.1bn of AUM across four funds; and WH Ireland confirmed it had executed a conditional agreement with Ravenscroft Holdings Limited to dispose of its Isle of Man subsidiary, WH Ireland (IOM) Limited with c. £350m AUM for a consideration of a maximum of £0.66m plus £1.14m of loan repayments.

In the IFA sector, Kingswood Wealth announced it had completed the acquisition of Sterling Trust Financial Consulting, a Yorkshire-based IFA group, for a total of £19.5m of which £7.25m was paid on completion. Independent Wealth Planners UK (IWP) acquired Greater London-based Clairville York Financial Advisers, bringing £374m of assets under advice to the business. It also purchased Stevenage-based financial planning firm Richmond House Wealth Management, with £250m in client assets and eight advisers as well as Westinsure Webb Financial Services, which will bring a total of £70m in AUM and two advisers. Chase de Vere announced the acquisition of Scottish firm Ferguson Oliver for a total consideration of £3.85m, increasing the group’s assets under advice by £180m. Truinvest bought Bromwich Financial Planning in a deal which followed the consolidator’s first acquisition of Group Rapport in March. Fairstone begun the acquisition of MT Financial Management, and Wealth Matters completed the purchase of the pension and investment clients of Poptani Financial Solutions. Ascot Lloyd announced that it had acquired six adviser firms during the first half of this year which have collectively added £1.2bn in AUM and £8m in annual revenue from over 2,300 clients, including Kemble Warwick, Corporate Benefits Consulting, Gregory Adam Financial Management, Fitzroy Wealth Management and Ring Associates.

Elsewhere, Aviva took full control of Wealthify, the online wealth manager, after the founders exercised their options to sell. Brown Shipley & Co, the private bank, sold its employee benefits business to Beckett Investment Management Group in East Anglia. Square Mile Investment Consulting and Research acquired Ethical Money and its trading entity 3D Investing, a research house that assesses the underlying holdings of impact funds based on whether they can make a “positive or measurable” environmental or social change. Premier Choice Healthcare, the specialist health insurance and protection broker, was acquired by GRP, the retail broking, specialist MGA and Lloyd’s business.

Finally, UK-based insurance provider LV= announced that it is considering selling its life and pension business following media speculation about the firm engaging advisers to put the remaining parts of the business up for sale.

Payments & Lending

In payments, e-commerce payments processor Checkout.com raised $150m in Series B funding, tripling its valuation to $5.5bn following a shift to online shopping during the global pandemic, led by Coatue, along with participation from existing investors, including Insight Partners, DST Global, Blossom Capital and GIC. Checkout.com also recently acquired payment processing platform Pin Payments. International remittance platform TransferGo raised $10m in funding led by Seventure as well as Vostok Emerging Finance and payments platform Apexx Global raised $8m in Series A funding with contributions from new and existing investors including Forward Partners, MMC and Alliance Ventures.

Singapore Exchange, acquired the remaining 80% stake in cloud-based FX trading platform BidFX from other shareholders for c. $128m in cash to expand SGX’s reach in the global FX over-the-counter (OTC) market, H4, the capital markets-based digital document analysis platform secured $27m in funding from a consortium including JP Morgan, Goldman Sachs as well as Barclays and Citi’s proxy voting platform Proximity raised $20.5m in a strategic investment round from a number of banks including BNY Mellon, Citi, Clearstream, Computershare, Deutsche Bank, HSBC, J.P. Morgan, and State Street. CubeLogic, the enterprise risk management solutions provider for the energy, commodities and financial markets, sold a significant minority stake to Growth Capital Partners, Codat, the real time business data technology company connecting small businesses to banks, fintechs and other financial institutions, raised $10m in venture funding from Index Ventures and TAINA, the financial institutions regulatory compliance specialist including banks, online trading platforms and fund administrators closed A Series A funding round including Anthemis, Tribeca ESP, Reciprocal Ventures and SIX Ventures.

Against the backdrop of a challenging market environment Monzo confirmed that it had closed a £60m fund raising at an implied pre-money valuation of c. £1.25bn, a significant decline from the reported c. £2bn valuation following the previous year’s £113m Series F raise. The fund raising was backed by new investors Reference Capital and Vanderbilt University alongside existing investors Y Combinator, General Catalyst, Accel, Stripe, Goodwater, Orange, Thrive and Passion Capital.

Amigo Holdings announced that it had concluded its formal sales process following the withdrawal of a potential acquirer given the current market environment. Separately, Amigo’s majority shareholder Richmond Group announced that it had placed all of its shares in Amigo with a broker, with irrevocable instructions to sell 1% of the company every trading day until Richmond’s stake was reduced to zero, in the event that the current board remained in place following the general meeting to consider Richmond Group’s resolutions to remove the Amigo Board. Following defeat of those resolutions, Richmond Group has begun its sell-down.

Having initially announced discussions in February 2020, Pollen Street Secured Lending announced, once again, that the Panel on Takeovers & Mergers had again consented to an extension of the relevant deadline until 14 July 2020 for funds advised by Waterfall Asset Management to conclude on a possible cash offer for the company.

Elsewhere, Metro Bank announced that it had entered in to a period of exclusivity with Retail Money Market, the peer-to-peer lender trading as RateSetter, but added that discussions regarding the potential acquisition were at an early stage.

Lockdown is doing odd things to some people’s perceptions of time, so first a reminder that May was just the second full calendar month in which most of the financial services world has been working from home, with varying degrees of effectiveness.

Zoom, Teams, Skype and Webex are now familiar to almost everyone and look here to stay. Commentators continue to make various prognostications about how the recent hiatus will change the ways in which we work. The death of the office is widely discussed, but as some of us gingerly plan a return to our usual place of work, it is worth remembering that with predictions that have accompanied other major changes in work practices – like the advent of email – such commentators have often had a tendency to overestimate the short term impact, but underestimate the long term.

M&A activity is continuing, albeit at a markedly slower pace. Fewer new deals are being initiated but for those already in motion, understanding and predicting the short- and long-term impact of the coronavirus on a transaction is at the front of buyers’ minds.

What does this mean in practice? Well, for transactions in the due diligence phase it means an increasing focus from buyers on how the target is responding to the Covid crisis. How is it impacting new business? How far are they utilizing government backed support schemes like furlough? How has it changed views on the medium term outlook for costs? – many companies have been forensically analyzing their cost base and are now actively considering whether they still need all the staff and office space that they had at the beginning of the year.

Such is the nature and level of uncertainty that few businesses can say with confidence that they can accurately forecast what the next 12 months will look like. This uncertainty is being reflected in the terms being agreed on transactions, partially in pricing but more commonly through the tweaking of terms, to shift the way risks are shared across buyer and seller. If deal terms outlined in February might have seen 70% of the consideration upfront with the remaining 30% contingent on performance over the next two years, then this might now be only 50% or 60% upfront. On one hand this is a deterioration in what a seller might have received for their business just a few months ago, but on the other it largely reflects the increased level of risk and uncertainty that they will still be subject to if they choose not to sell.

If you would like to discuss how the current situation is impacting your own company’s thoughts or plans for M&A, either in the short or long term and whether as a buyer or seller, do get in touch.

Insurance

As May took the UK into the third full calendar month of lockdown it will come as no surprise that the number of announced M&A deals fell dramatically. Indeed, the biggest Insurance M&A story of the month was about a deal that didn’t happen – with French insurer Covea announcing that it was pulling out of a previously agreed $9bn deal to acquire PartnerRe, despite having publicly said it was committed to the transaction just a few weeks earlier.

The coronavirus pandemic is clearly having a major impact on the insurance sector and with Lloyd’s of London announcing during May that it expects to pay out £3.5bn in claims as a result, it came as little surprise to see two of its largest insurers raising new capital. Embattled insurer Hiscox announced a share placing to raise £375m and was quickly followed by Beazley, who raised £247m through a placing.

There was again M&A activity within the MGA segment, with London-based platform OneAdvent announcing the acquisition of Modus Underwriting from CFC Underwriting. Modus is a digital-first MGA providing niche property insurance.

Within insurance distribution, M&A activity was very limited. Towergate announced two small transactions that it had agreed earlier in the year, acquiring Chippenham-based farm insurance specialist Edwards & Swan Insurance Brokers and a separate deal to buy the book of Education Staff Absence insurance business from Integro Insurance Brokers. The cash consideration in both deals was less than £1m.

Within Insurance services, credit-hire and post-accident services provider Edam Group acquired motor claims business Kingsway Claims.

Lastly, there was continuing financing activity within Insuretech, with a number of high-profile firms raising new capital and demonstrating the continuing appetite among VCs for disruptive insurance business, particularly in personal lines. Innovative pet insurance business Bought By Many announced that it had raised a further £78m of growth equity, cycle insurance specialist Bikmo raised £1.8m in a Series A round that saw participation from insurer Hiscox, and pay-per-mile startup By Miles added £15m in a Series B funding round led by CommerzVentures, the corporate venture capital fund of Germany’s Commerzbank Group.

Investment

The life company Royal London announced the sale of its platform business Ascentric to the fund management group M&G. Around 1,500 advisers use the Ascentric platform, which holds assets under administration of £14bn on behalf of 90,000 customers. It has been part of Royal London since 2017.

With over 95% of them voting in favour, Jupiter’s shareholders gave the fund house their stamp of approval to acquire rival firm Merian Global Investors for £370m later this summer.

US private equity firm Warburg Pincus is injecting around £250m into the merger of Tilney and Smith & Williamson to co-invest in the combined business alongside funds advised by Permira, the private equity group that currently owns Tilney, resulting in a significant reduction in external debt for the combined group. It raises expectations for the transaction to complete in the second half of this year and create a group to be called Tilney Smith & Williamson which is expected to manage £44bn in assets and generate c. £530m of revenue.

Fairstone, the national advice group, added three firms to its buyout programme; Yorkshire-based Brantwood Financial Planning; Durham-based Advanced Financial Services; and Cumbria-based Financial Concepts. Once acquired, Fairstone will gain over £300m funds under management from the three acquisitions.

Elsewhere, digital wealthtech firm Smarterly raised £7m in a Series A funding round led by Major Oak and topped up by angel/crowdfunding investors, the fintech pensions business Smart closed a strategic investment from asset management firm Natixis Investment Management, and Octopus Ventures led a $12.6m Series B funding round in Stackin, the text-based personal finance platform to support its UK launch.

Payments & Lending

In payments, Modulr, a UK Payments-as-a-Service API platform for digital businesses, raised £18.9m in a funding round led by Highland Europe with participation from Frog Capital and Blenheim Chalcot, Global Reach Group, the foreign exchange risk management and payment services business, acquired key elements of EncoreFX’s Canadian operation to expand its global footprint and Fly Now Pay Later, the payment provider for the travel sector raised £35m in Series A equity and debt funding led by Revenio Capital with participation from Shawbrook Bank and BCI Finance.

IBM has taken a 7% stake in we.trade, the blockchain-based trade finance network owned by 12 banks including CaixaBank, Deutsche Bank, Erste Group, HSBC, KBC, Nordea, Rabobank, Santander, Société Générale, UBS as well as UniCredit and commission-free stockbroking app Freetrade has raised £4.5m from more than 5,000 people, using crowdfunding platform Crowdcube.

Citigroup span off its electronic proxy voting platform Proxymity to a consortium of banks backing the new venture with $20.5m including BNY Mellon, Citi, Clearstream, Computershare, Deutsche Bank, HSBC, JPMorgan, and State Street. Meniga, the digital banking technology business closed a €8.5m in additional funding round led by Groupe BPCE, with Grupo Crédito Agrícola and UniCredit and Barclays invested in SaveMoneyCutCarbon, the carbon footprint digital aggregator marketplace.

Elsewhere, financial fraud fighting platform Featurespace raised £30m in a funding round led by Merian Chrysalis Investment and supported by existing investors, ANNA, the mobile-first banking, tax accounting and financial service assistant aimed at small and medium businesses and freelancers, closed a £17.5m round of investment from the ABHH Group, which values ANNA at $110m and enables the founders to retain 40% of the company. Octopus Ventures led a $12.6m Series B funding round in Stackin, the text-based personal finance platform to support its UK launch,digital wealthtech firm Smarterly raised £7m in a Series A funding round led by Major Oak and topped up by angel/crowdfunding investors, and savings technology platform Smart closed a strategic investment from asset management firm Natixis Investment Management.

In line with the broader market, the lending M&A markets continued to be impacted by the ongoing pandemic, typified by Pollen Street Secured Lending announcing that the Panel on Takeovers & Mergers had once again consented to an extension of the relevant deadline until 16 June 2020 for funds advised by Waterfall Asset Management to conclude on a possible cash offer for the company.

However, there were still pockets of activity, notably in digital banking where Starling Bank announced it had raised £40m in a funding round led by JTC and Merian Chrysalis Investment Company; and in the SME lending sector where British Business Investments, a subsidiary of the British Business Bank, announced a commitment of £35m to Harwood Private Capital UK at its first close of its UK SME fund of £70m. In addition, 1pm announced that it had been notified that Cloverleaf 374, a subsidiary of Wellesley Group, had acquired a 19.99% shareholding in the company. Neobank Monzo is also widely reported to be seeking fresh funding at a £1.25bn valuation, which would be a c. 40% discount on its previous valuation of £2bn.

Amigo Holdings provided an update on its formal sale process, announcing that it had received a potential offer at 20.9p per ordinary share, subject inter alia to Amigo’s controlling shareholder, Richmond Group, providing an irrevocable undertaking to vote in favour of the transaction and to halt its steps to change the board composition. However, Amigo had been unable to engage constructively and ascertain Richmond Group’s willingness or not to accept the potential offer.

In separate announcements, Amigo announced that the FCA had launched an investigation into its regulatory compliance with respect to credit assessment; and that Amigo had filed an application for an injunction to prevent Richmond Group from voting in favour of its resolution to remove the entire Amigo board and to appoint its own director nominees.

M&A transactions happen when the buyer and seller share a common view on value. That value is inevitably a point-in-time snapshot, based on each counterparty’s view about what the future looks like for that business. Views on value change over time and as with the price of a listed share, the price for any business can be very different in three months’ time than it is today, higher or lower.

Given the uncertainty inherent in the economy and rapidly changing views on what the future might look like, it is far from certain that the price agreed for any company today will still be accepted by both parties in three months’ time, once the necessary due diligence and legal documentation involved in any deal have been completed.

Until a consensus emerges around both the direction of the economy and the impact of the shutdown on individual companies, we do not expect to see a material rebooting of M&A activity. The level of uncertainty is such that at the moment, we see that acquirers are being much more cautious in their approach and delving further into detail before they commit to make transactions happen.

M&A activity levels were weak against historic norms in Q1 2020, around 20% down. Below, we comment of the drop in activity during April in the sector reviews, but suffice to say we expect Q2 out-turn to be far lower even than was experienced in the financial crisis of 2008.

Many acquirers are still ‘open for business’, but we know from their actions that this is on a much more diligent basis and it is taking materially longer to get to a successful conclusion. Sentiment can change quickly and when it does we will be advising our clients accordingly. However, the message for most sellers today is to hunker down, look after your clients and protect tomorrow’s value.

Insurance

It will perhaps come as little surprise given how much of the economy was either closed or curtailed for the month that there was a sharp decline in the volume of announced Insurance M&A in the month, with only a fraction of the number of transactions seen in a ‘typical’ month (there was just one deal with a value estimated at more than £5m in April, against a monthly average of 2.4 deals in this size range in the sector over the past five years). It remains to be seen how long this might continue, but while we remain in lockdown and until there is greater certainty around the economic outlook, we would expect Insurance M&A volumes to remain subdued. With a large number of ongoing transactions currently paused or just having slowed down, any return to some semblance of normality could well see a quick uptick in announced deals.

Among commercial brokers, two of the ‘hub and spoke’ based consolidators announced further deals, with Global Risk Partners hub business Green Insurance Group acquiring Brighton-based broker RT Williams Insurance Brokers and its appointed representative NIB Insurance Brokers, and Ethos Broking added another deal with the acquisition of Compass member Hughes & King.